Bitcoin at $120k+? This Changes Everything.

While most people pay $120k+ for Bitcoin, there's a smarter way to acquire it at production cost through professional mining operations.

The math is simple: Why buy Bitcoin at peak prices when you can generate it for a fraction of the cost? Abundant Mines handles everything - from equipment selection to daily operations in green energy facilities.

You receive daily Bitcoin payouts, claim massive tax write-offs through equipment depreciation, and build real wealth through Bitcoin generation rather than speculation. No technical knowledge required. No equipment headaches. No management responsibilities.

This approach works because you're accumulating Bitcoin below market rates while traditional investors pay premium prices. Our professional-grade facilities ensure maximum uptime and profitability.

Limited spots available due to facility capacity. Smart entrepreneurs are already positioning themselves while others hesitate.

Get started with a free month of professional Bitcoin hosting before the next price surge.

Welcome to Build + Brand, a newsletter dedicated to exploring the art and strategy of commercial real estate development. Each issue dives into lessons learned, best practices, and real-world insights from our journey building purpose-built facilities—like our flagship ProTrade Garages™—while also sharing broader strategies that apply to developers, investors, and operators across the commercial real estate space. From site selection and construction tips to branding, tenant engagement, and maximizing property value, Build + Brand is here to give you the tools and inspiration to build smarter, brand stronger, and create spaces that truly work for both tenants and owners alike.

Featured Article

The Financing Challenge

Every developer knows the excitement of bringing a new project to life—choosing the site, designing the building, envisioning the tenants. But there’s a hurdle that often determines whether a project becomes reality: financing.

For lenders, the stakes are high. They’re not just evaluating your building plans—they’re evaluating risk. Is there real tenant demand? Is the property durable and adaptable enough to hold long-term value? And perhaps most importantly, is there a clear strategy for repayment or exit?

While every lender has its own underwriting criteria, most want reassurance in four critical areas. Addressing these upfront can make the difference between a smooth approval and a financing roadblock.

1. Clear Market Demand

Lenders want proof that your project is solving a real need in the market. This goes beyond optimism—it requires data.

Vacancy Rates: Show that your product type isn’t oversupplied.

Absorption Trends: Demonstrate how quickly comparable properties are being leased or sold.

Tenant Pipeline: Pre-leasing agreements, LOIs, or even documented tenant interest can strengthen your case.

Pro tip: Go beyond general market reports. Present tailored, local insights—like how many contractors in your region lack properly sized service bays, or how many retailers are seeking smaller-footprint spaces in a submarket. Lenders trust projects backed by specific, relevant data.

2. Strong Tenant Profile

Not all tenants are equal in the eyes of a lender. Large national brands carry weight, but smaller, regional operators can also strengthen your case—if you frame it correctly.

Lease Terms: Long-term leases show stability.

Creditworthiness: Highlight tenant financials or industry track record.

Fit-for-Use: Demonstrate how the space is designed around tenant operations, reducing turnover risk.

Remember: A well-matched tenant in a purpose-built facility often represents less risk than a misaligned tenant in a generic building. Lenders want to know your tenants aren’t just filling space—they’re committed.

3. Functional, Durable Design

Buildings that can only serve one purpose make lenders nervous. The more flexible and durable your design, the safer it looks as collateral.

Flexibility: Could the building serve multiple tenant types with minimal modification?

Durability: Are you using materials that hold up over time and lower maintenance costs?

Future-Proofing: Does the design allow for technological upgrades, operational shifts, or growth in tenant businesses?

A property that can evolve with market needs is far more attractive to lenders—and eventually, buyers.

4. Exit Strategy

Even the best developments face unforeseen challenges. Lenders want to know you’ve thought ahead.

Resale Market: Could the building attract a wide pool of investors if sold?

Refinancing Options: Is there a clear path to refinance after stabilization?

Repositioning Potential: If the initial use changes, can the building adapt?

Framing your exit strategy signals to lenders that you’re not just optimistic—you’re pragmatic.

Why This Matters

Financing isn’t just a box to check. The terms you secure shape your entire project’s profitability. Developers who walk into lender meetings armed with data, tenant insights, and adaptable design strategies consistently secure:

Lower interest rates

More favorable loan-to-value ratios

Faster closings

In a competitive lending environment, preparation is leverage.

Tip for Developers

When preparing your financing package, ask yourself:

👉 “Am I proving this project fills a real market need, has durable design, and gives lenders a safe exit?”

If the answer is yes, you’re not just building confidence—you’re building a financeable project.

Spotlight: Building Your Own ProTrade Garage

Have you ever thought about owning a purpose-built mini-warehouse facility for contractors—one that combines functionality, durability, and a recognizable brand? ProTrade Garages makes that possible.

By investing in or branding your own Pro Trade Garage development, you can:

Attract Reliable Tenants: Purpose-built, branded facilities appeal to contractors who need spaces designed for their workflow.

Command Premium Returns: Branded properties often achieve higher rents, lower vacancies, and long-term value growth.

Leverage a Proven Model: Our designs, layouts, and branding strategy are optimized for efficiency, tenant satisfaction, and investor ROI.

www.protradegarages.com

Whether you’re an investor looking for a new opportunity, or a property owner wanting to reimagine an existing facility, partnering with ProTrade Garages™ allows you to create a high-value asset while helping contractors operate more efficiently.

Next Step: Interested in learning how you can build, brand, and launch your own Pro Trade Garage? Let’s start a conversation and explore the possibilities.

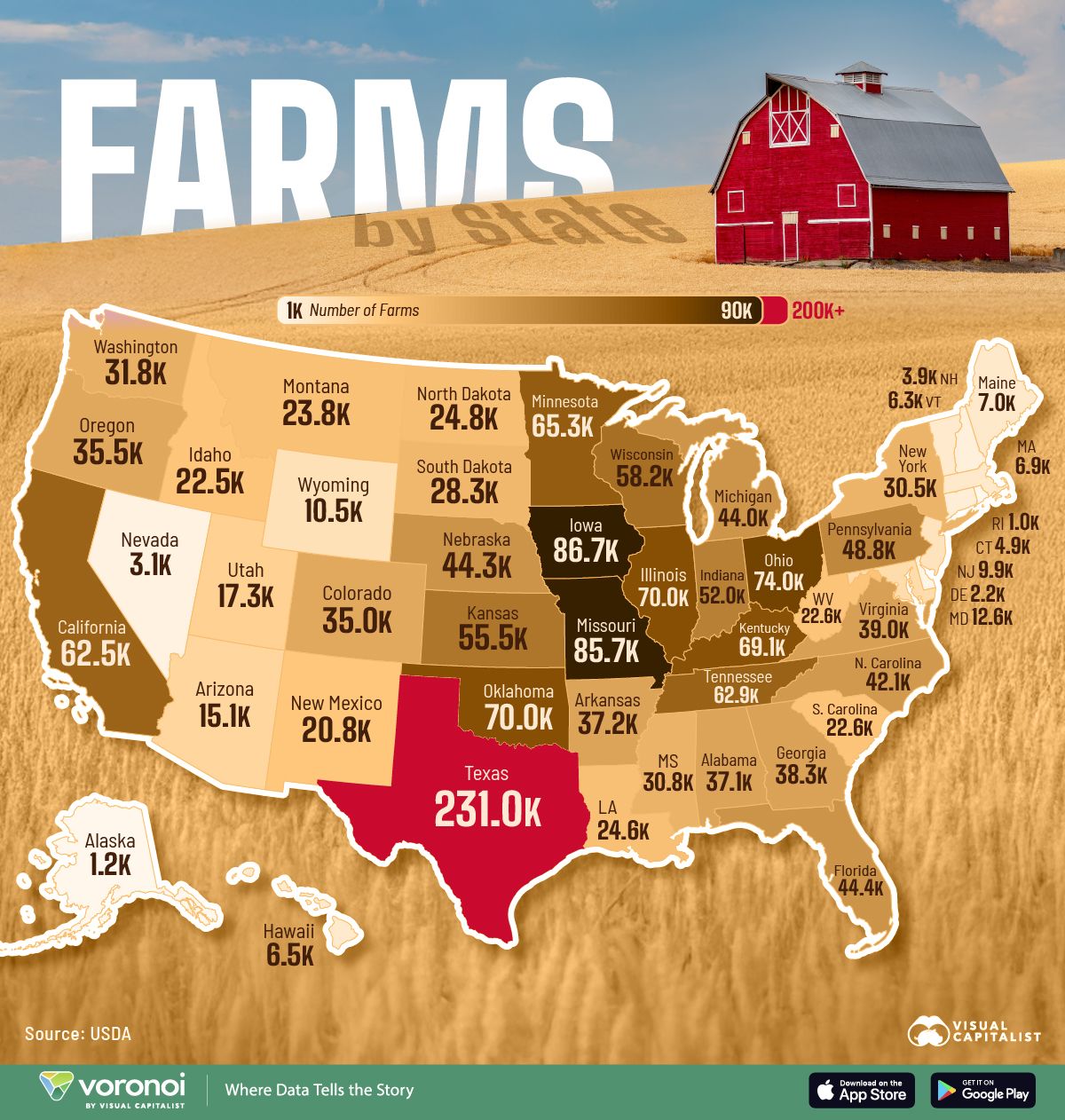

Visual of the Day

Thanks for reading this edition of Build + Brand. We hope these insights and stories inspire you to think differently about commercial real estate development, purpose-built facilities, and branded spaces like ProTrade Garages™.

Want to dive deeper? Here are a few ways to stay connected and take action:

Learn More: Explore our current and upcoming development projects.

Get Involved: Interested in partnering or investing? Let’s start the conversation.

Share Your Ideas: Have a development challenge or story to share? We’d love to hear from you.

Stay tuned for the next issue, where we’ll share more lessons, tips, and behind-the-scenes insights from the world of Build + Brand.