🏢 Your Source for Commercial Real Estate, Business Brokerage and M&A Insights

At Hughes Commercial, we deliver actionable insights and strategies at the intersection of commercial real estate (CRE), business brokerage, and mergers & acquisitions (M&A). Each edition unpacks market trends, investment strategies, and deal-making opportunities to help you navigate CRE assets, business transactions, and portfolio growth.

Whether you're exploring income-producing properties or negotiating business deals, our goal is to equip you with the tools to seize opportunities and build lasting success.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Featured Article

When investors talk about “mailbox money,” they’re often talking about one thing: single-tenant net lease (STNL) real estate. Even with interest rate volatility, shifting consumer behaviors, and evolving capital markets, STNL continues to outperform other income-producing assets when it comes to stability, predictability, and passive yield.

Here’s why STNL still sits on the throne of passive income:

✅ 1. Lease Structure = Predictable Cash Flow

STNL assets—especially those with NNN and absolute NNN leases—shift nearly all operating costs to the tenant. That means:

No property maintenance

No insurance or tax headaches

No expense pass-through complexities

No operational oversight

In many cases, the owner is responsible for nothing beyond collecting a guaranteed monthly check.

✅ 2. Long-Term Leases Offer Stability

Most STNL leases run 10–20 years with built-in rent increases. And when tenants exercise renewals, investors benefit from an even longer stream of fixed income without ever lifting a finger.

This is especially appealing for:

1031 exchange buyers

Family offices

Retirees and estate planners

Business owners transitioning wealth

✅ 3. Credit-Backed Tenancy Reduces Risk

Tenants like CVS, AutoZone, 7-Eleven, Dollar General, Starbucks, and Chase Bank bring corporate-guaranteed leases with strong creditworthiness. Even franchise-backed deals often come with proven performance and national brand support.

For investors, that means reduced default risk and stronger resale value.

✅ 4. Truly Passive Ownership

Unlike multifamily, office, or hospitality, STNL ownership doesn’t require:

Tenant turnover

CapEx planning

Leasing commissions

Property management teams

There’s no late-night calls, no chasing tenants, and no operating budget surprises.

✅ 5. Liquidity & Exit Flexibility

STNL assets retain strong buyer demand nationwide from REITs, institutions, and private investors. That means liquid exit options and competitive cap rate environments—especially for long leases with strong brands.

Even in a higher-rate environment, STNL pricing has held up better than most product types.

✅ 6. Tax Advantages & Legacy Planning

STNL deals pair well with:

1031 exchanges

Cost segregation studies

Estate planning strategies

LLC and trust structuring

Investors can defer taxes, shelter income, and transition assets to the next generation with ease—making STNL not just passive income, but multigenerational wealth planning.

✅ 7. Sector Diversification Without the Work

STNL spans nearly every resilient industry:

Convenience & fuel

QSR & fast-casual dining

Automotive service

Dollar & discount retail

Medical and pharmacy

Banking & financial

Industrial and logistics

You can diversify your portfolio without managing a dozen tenants.

The Bottom Line

In an era where investors crave reliable yield without the operational burden, STNL continues to lead the pack. The combination of corporate-backed leases, minimal landlord responsibilities, and strong exit demand has kept single-tenant net lease at the top of the passive income pyramid.

If passive income is the goal, STNL is still the king.

🚀 Fast-Track Your Property Sale with Our 100-Day List-to-Close Solution

Looking to sell your commercial property quickly and efficiently? Hughes Commercial, in partnership with Ten-X, offers a streamlined process to take your property from listed to closed in just 100 days. Here’s how we make it happen:

🔹 Efficient, Low-Risk Selling with Ten-X 🔹

✅ Streamlined Process

45-day targeted marketing campaign

48-hour online bidding event

Non-contingent closing within ~30 days for fast, reliable execution

✅ No Upfront Costs

Sellers pay nothing upfront—Ten-X is compensated by the buyer upon a successful sale

✅ Seller Protection

Set a reserve price and sell only if that price is met, minimizing downside risk

✅ High Certainty of Close

Buyers are prequalified and must provide proof of funds

10% non-refundable earnest money deposit (EMD) required from day one

✅ Comprehensive Due Diligence

Phase I and Property Condition Assessment reports (~$2,200 each) provided upfront

Sellers reimburse Ten-X only if the property sells—otherwise, the reports are free

✅ Global Buyer Reach & Premium Marketing

Exposure to a vast network of qualified buyers through CoStar, LoopNet, and Ten-X

Complimentary Diamond Ad included ($30,000–$50,000 value) for maximum visibility

👉 Maximize your property's value with a proven platform—contact us today to get started!

🔎 Did You Know?

We offer one-time Commercial Real Estate and Business Estimates of Value to help you make smarter decisions.

✅ Nationwide Commercial Real Estate & Business Valuation Reports

Our comprehensive research and data services deliver valuable insights for investors, brokers, and business owners—empowering you to make data-driven decisions with confidence.

💼 Business Estimates of Value

Curious about what your business is worth in today’s market? Our business valuation reports give you a clear understanding of your company’s value—so you can plan your next move with certainty.

🌍 Access Nationwide Commercial Property Data

✔️ Ownership Records & Transaction History – Get detailed property information, including past sales, lease comps, and ownership records for accurate valuations.

✔️ Market Analytics & Insights – Stay ahead with reports on vacancy rates, rental trends, construction activity, and economic forecasts.

✔️ Lease & Tenant Information – Understand tenant portfolios, lease expirations, and key contact details.

📩 Get the Data You Need

Looking for specific insights? Let us know what you need, and we’ll customize a report tailored to your goals.

👉 Contact us today to unlock valuable insights for your next deal!

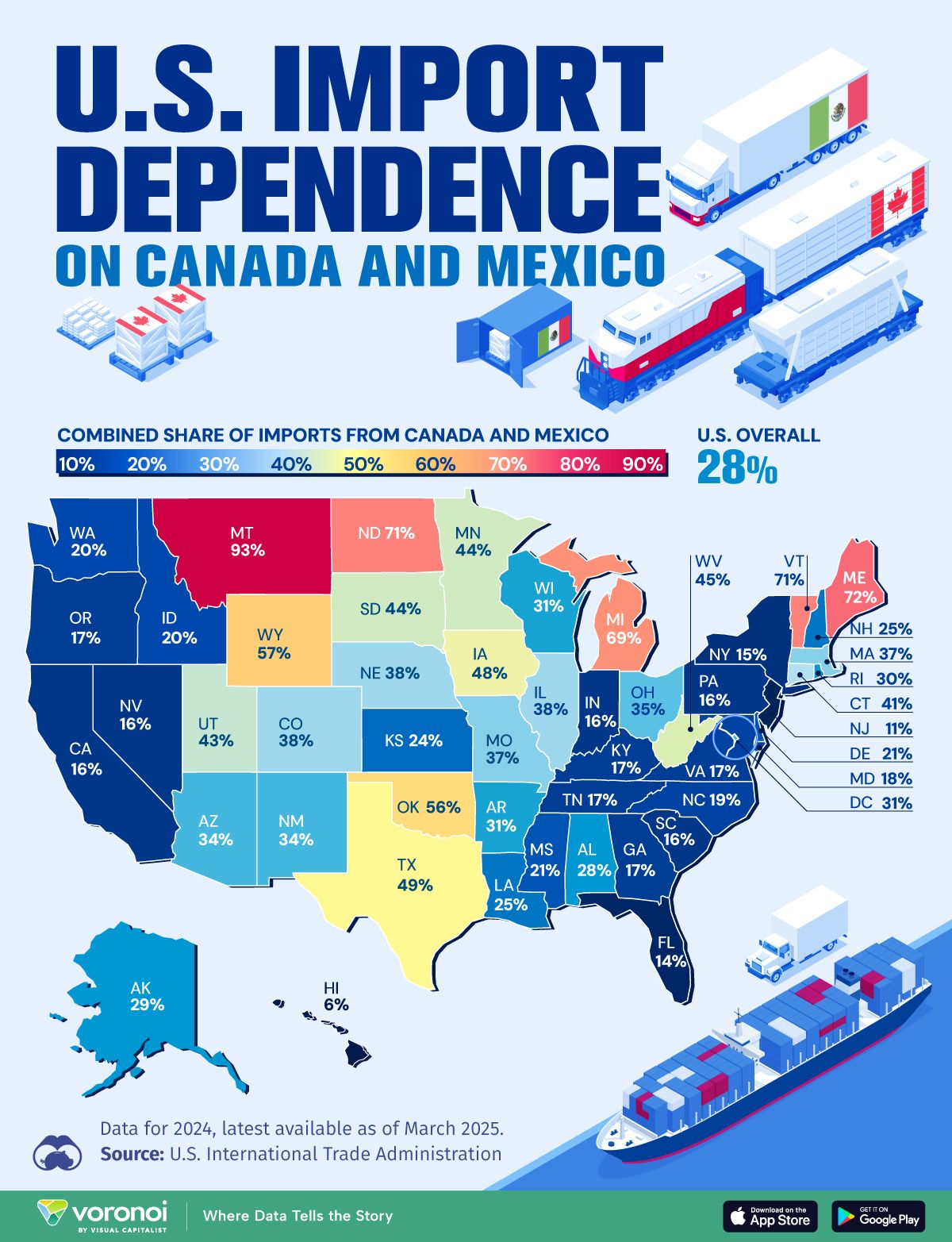

Visual of the Day

Was this email forwarded to you? Don't miss out on this valuable opportunity to elevate your knowledge and expertise in the world of commercial real estate, business brokerage and M&A activity. Sign up for Hughes Commercial Insider today and join our community of commercial real estate professionals committed to success.

To subscribe to Hughes Commercial Insider and stay up-to-date with the latest insights, click here (Subscribe).

Best regards,

Hughes Commercial