🏢 Your Source for Commercial Real Estate, Business Brokerage and M&A Insights

At Hughes Commercial, we deliver actionable insights and strategies at the intersection of commercial real estate (CRE), business brokerage, and mergers & acquisitions (M&A). Each edition unpacks market trends, investment strategies, and deal-making opportunities to help you navigate CRE assets, business transactions, and portfolio growth.

Whether you're exploring income-producing properties or negotiating business deals, our goal is to equip you with the tools to seize opportunities and build lasting success.

Learn how to make every AI investment count.

Successful AI transformation starts with deeply understanding your organization’s most critical use cases. We recommend this practical guide from You.com that walks through a proven framework to identify, prioritize, and document high-value AI opportunities.

In this AI Use Case Discovery Guide, you’ll learn how to:

Map internal workflows and customer journeys to pinpoint where AI can drive measurable ROI

Ask the right questions when it comes to AI use cases

Align cross-functional teams and stakeholders for a unified, scalable approach

Featured Article

For many business owners, one thing has become abundantly clear in today’s environment: your real estate may be worth more to you as cash than as an owned asset.

That’s why sale-leasebacks—long a staple of corporate finance—are experiencing a major resurgence in 2025. With higher borrowing costs, tighter lending standards, and rapid expansion goals across retail, automotive, c-store, and industrial sectors, companies are looking for ways to unlock capital without taking on new debt.

A sale-leaseback often becomes the smartest move in the playbook.

🏦 What’s Driving the Current Sale-Leaseback Wave?

Over the past 12–18 months, we’ve seen a consistent pattern across operators:

1. Banks are requiring more equity.

Higher interest rates have made traditional financing more expensive. Many lenders now require 25–35% equity in commercial deals.

A sale-leaseback converts a fixed asset into liquid capital—often 100%+ monetization compared to what a lender would finance.

2. Expansion is happening fast across multiple industries.

Operators in the c-store, QSR, automotive, and distribution sectors are adding units quickly. Real estate ownership slows expansion; liquidity speeds it up.

3. Investors are actively chasing stable, long-term STNL deals.

Demand for long-term, NNN-leased properties with strong operators hasn’t slowed. Investors want predictable income.

This demand supports strong pricing—meaning owners can often sell at premium valuations while staying in place as the tenant.

💡 How a Sale-Leaseback Actually Creates Value

For many operators, the instinct is to hold onto real estate forever. But in today’s market, a sale-leaseback can be more strategic:

1. Grow the business using your own capital.

Operators free up cash for:

New store openings

Fleet expansion

Technology upgrades

Workforce investment

Debt reduction

2. Reduce balance-sheet pressure.

A sale-leaseback converts a non-income-producing asset into cash while turning occupancy costs into a predictable lease payment.

3. Lock in control of the property.

With a long-term lease (10–20 years), the operator maintains operational control with no disruption.

4. Improve overall return on capital.

Real estate might appreciate 3–6% per year.

Your business might generate 15–30%+ returns.

A sale-leaseback re-allocates capital toward the higher-yield engine.

📊 What Investors Are Looking For Right Now

If you’re considering a sale-leaseback, this is what the market rewards:

Strong operating history and financials

Essential-service businesses (fuel, auto, QSR, medical, logistics)

Corporate or multi-unit guarantees

Long terms (15–20 years preferred)

Rental escalations tied to inflation or fixed growth

If your real estate fits this box, today’s market may assign a cap rate significantly lower than your cost of capital—which is exactly why these deals work.

🧭 Is a Sale-Leaseback Right for You?

Here are the questions I encourage owners to ask:

Is your real estate tying up capital that could grow your business?

Are lenders restricting how quickly you can expand?

Do you want to pay off high-interest debt?

Do you expect better returns reinvesting in operations?

Would improved liquidity strengthen your balance sheet?

If the answer is yes to any of these, a sale-leaseback is worth evaluating.

🔍 The Bottom Line

In a market where capital efficiency matters more than ever, sale-leasebacks give operators a powerful tool to unlock equity, accelerate growth, and strengthen long-term financial position.

Investors benefit from stable, long-term NNN cash flow.

Operators benefit from liquidity and expansion capital.

It’s a win-win model that’s only gaining momentum in 2025.

If you want to review the real estate you currently own—or explore whether a sale-leaseback could support your growth plans—reply to this email. I’m happy to run the numbers and map out your options.

🚀 Fast-Track Your Property Sale with Our 100-Day List-to-Close Solution

Looking to sell your commercial property quickly and efficiently? Hughes Commercial, in partnership with Ten-X, offers a streamlined process to take your property from listed to closed in just 100 days. Here’s how we make it happen:

🔹 Efficient, Low-Risk Selling with Ten-X 🔹

✅ Streamlined Process

45-day targeted marketing campaign

48-hour online bidding event

Non-contingent closing within ~30 days for fast, reliable execution

✅ No Upfront Costs

Sellers pay nothing upfront—Ten-X is compensated by the buyer upon a successful sale

✅ Seller Protection

Set a reserve price and sell only if that price is met, minimizing downside risk

✅ High Certainty of Close

Buyers are prequalified and must provide proof of funds

10% non-refundable earnest money deposit (EMD) required from day one

✅ Comprehensive Due Diligence

Phase I and Property Condition Assessment reports (~$2,200 each) provided upfront

Sellers reimburse Ten-X only if the property sells—otherwise, the reports are free

✅ Global Buyer Reach & Premium Marketing

Exposure to a vast network of qualified buyers through CoStar, LoopNet, and Ten-X

Complimentary Diamond Ad included ($30,000–$50,000 value) for maximum visibility

👉 Maximize your property's value with a proven platform—contact us today to get started!

🔎 Did You Know?

We offer one-time Commercial Real Estate and Business Estimates of Value to help you make smarter decisions.

✅ Nationwide Commercial Real Estate & Business Valuation Reports

Our comprehensive research and data services deliver valuable insights for investors, brokers, and business owners—empowering you to make data-driven decisions with confidence.

💼 Business Estimates of Value

Curious about what your business is worth in today’s market? Our business valuation reports give you a clear understanding of your company’s value—so you can plan your next move with certainty.

🌍 Access Nationwide Commercial Property Data

✔️ Ownership Records & Transaction History – Get detailed property information, including past sales, lease comps, and ownership records for accurate valuations.

✔️ Market Analytics & Insights – Stay ahead with reports on vacancy rates, rental trends, construction activity, and economic forecasts.

✔️ Lease & Tenant Information – Understand tenant portfolios, lease expirations, and key contact details.

📩 Get the Data You Need

Looking for specific insights? Let us know what you need, and we’ll customize a report tailored to your goals.

👉 Contact us today to unlock valuable insights for your next deal!

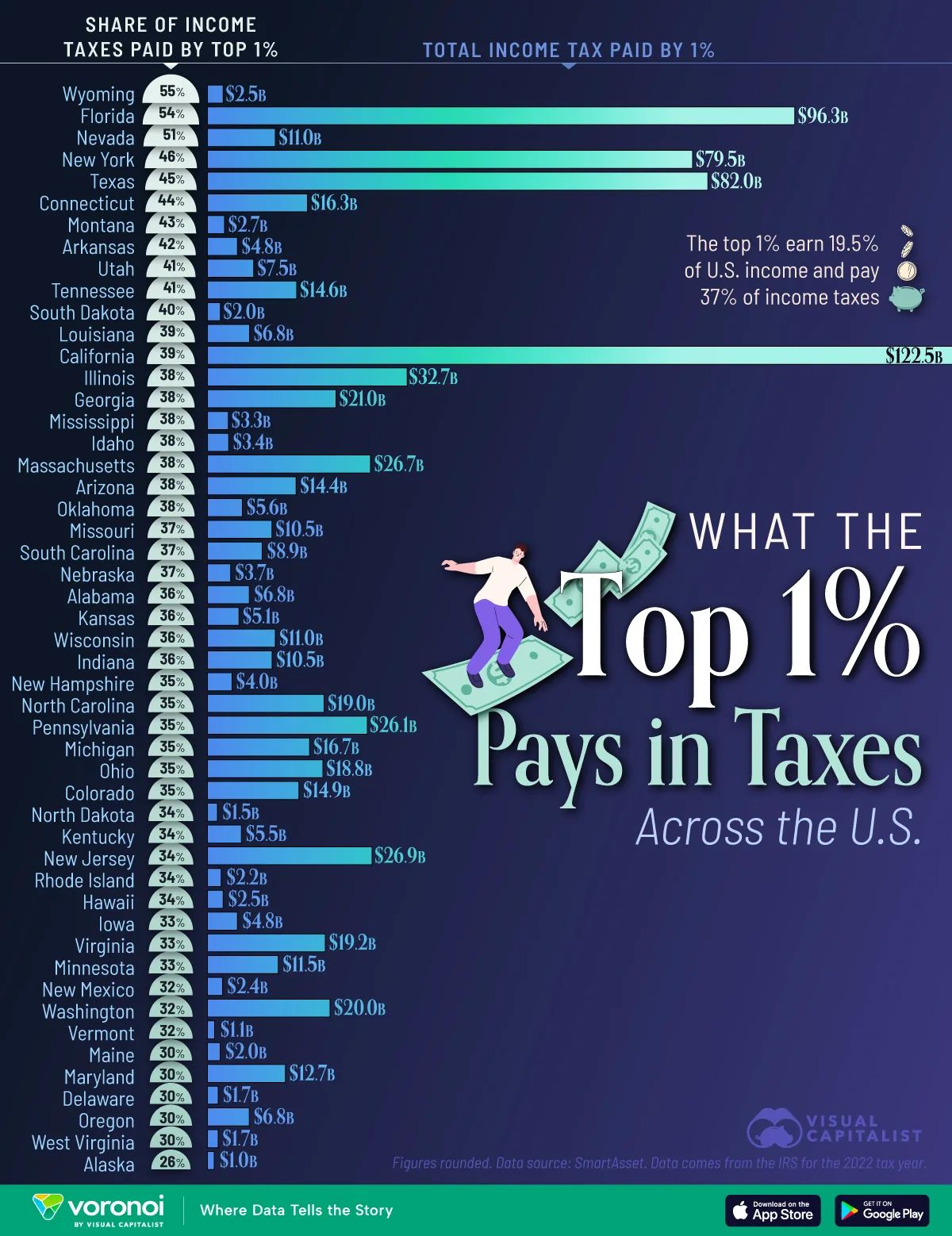

Visual of the Day

Was this email forwarded to you? Don't miss out on this valuable opportunity to elevate your knowledge and expertise in the world of commercial real estate, business brokerage and M&A activity. Sign up for Hughes Commercial Insider today and join our community of commercial real estate professionals committed to success.

To subscribe to Hughes Commercial Insider and stay up-to-date with the latest insights, click here (Subscribe).

Best regards,

Hughes Commercial