🏢 Your Source for Commercial Real Estate, Business Brokerage and M&A Insights

At Hughes Commercial, we deliver actionable insights and strategies at the intersection of commercial real estate (CRE), business brokerage, and mergers & acquisitions (M&A). Each edition unpacks market trends, investment strategies, and deal-making opportunities to help you navigate CRE assets, business transactions, and portfolio growth.

Whether you're exploring income-producing properties or negotiating business deals, our goal is to equip you with the tools to seize opportunities and build lasting success.

The key to a $1.3T opportunity

A new trend in real estate is making the most expensive properties obtainable. It’s called co-ownership, and it’s revolutionizing the $1.3T vacation home market.

The company leading the trend? Pacaso. Created by the founder of Zillow, Pacaso turns underutilized luxury properties into fully-managed assets and makes them accessible to the broadest possible market.

The result? More than $1b in transactions, 2,000+ happy homeowners, and over $110m in gross profits for Pacaso.

With rapid international growth and 41% gross profit growth last year, Pacaso is ready for what’s next. They even recently reserved the Nasdaq ticker PCSO.

But the real opportunity is now, before public markets. Until 5/29, you can join leading investors like SoftBank and Maveron for just $2.80/share.

This is a paid advertisement for Pacaso’s Regulation A offering. Please read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals. Under Regulation A+, a company has the ability to change its share price by up to 20%, without requalifying the offering with the SEC.

Featured Article

The commercial real estate industry has never been short on shiny new tools — but in 2025, the question isn’t what’s available, it’s what’s worth using.

From lease tracking to AI-powered deal analysis, a wave of smart proptech is finally living up to the hype — and giving brokers, investors, and owners a competitive edge.

Here’s a roundup of the tools worth your attention this year:

📑 1. Lease Management Platforms

What It Solves: Lost rent escalations, missed critical dates, and poor visibility across portfolios.

Top Picks:

Visual Lease for compliance-heavy portfolios

Leasecake for simple NNN/retail tracking

Prophia for AI-powered lease abstraction

Why It Matters: If your rent roll still lives in Excel, you’re flying blind. Lease platforms let you surface value—and risk—in seconds.

🤖 2. AI Underwriting & Deal Analysis

What It Solves: Time-consuming manual underwriting, scattered deal comps, and subjective decision-making.

Top Picks:

Juniper Square for investor reporting + financial modeling

Cherre and Lev for pulling comps and underwriting faster

Valcre for appraisers and brokers

Why It Matters: These platforms don’t replace expertise—they accelerate it. Speed + accuracy = better offers, faster closes.

📊 3. CRE Data Aggregators & Mapping

What It Solves: Time spent chasing tax records, comps, and tenant footprints.

Top Picks:

Reonomy for ownership and debt data

Placer.ai for foot traffic and trade area analytics

LandVision for GIS-based parcel research

Why It Matters: Whether you’re scouting a site or pitching a deal, the data arms race is real. These tools help you win it.

🔌 4. Tenant & Occupant Experience Tools

What It Solves: Vacant space, tenant churn, and lack of engagement.

Top Picks:

HqO for tenant satisfaction tracking

Building Engines for property ops + work orders

Breezeway for automating maintenance in NNN-heavy portfolios

Why It Matters: Happy tenants = longer leases. These tools boost retention and operational efficiency.

🧠 Final Thought: Use Tech to Multiply Your Talent

The best proptech in 2025 won’t replace you—it’ll scale you. Whether you’re managing leases, underwriting acquisitions, or trying to land the next tenant, the right tools help you act faster and smarter.

Think of it this way: your competition is probably using these tools already. The real question is—are you?

—

Need help selecting tech tools for your brokerage or portfolio?

Let’s connect. We’ll help you separate the signal from the noise.

—

Hughes Commercial | Real Estate & Business Advisory

🚀 Fast-Track Your Property Sale with Our 100-Day List-to-Close Solution

Looking to sell your commercial property quickly and efficiently? Hughes Commercial, in partnership with Ten-X, offers a streamlined process to take your property from listed to closed in just 100 days. Here’s how we make it happen:

🔹 Efficient, Low-Risk Selling with Ten-X 🔹

✅ Streamlined Process

45-day targeted marketing campaign

48-hour online bidding event

Non-contingent closing within ~30 days for fast, reliable execution

✅ No Upfront Costs

Sellers pay nothing upfront—Ten-X is compensated by the buyer upon a successful sale

✅ Seller Protection

Set a reserve price and sell only if that price is met, minimizing downside risk

✅ High Certainty of Close

Buyers are prequalified and must provide proof of funds

10% non-refundable earnest money deposit (EMD) required from day one

✅ Comprehensive Due Diligence

Phase I and Property Condition Assessment reports (~$2,200 each) provided upfront

Sellers reimburse Ten-X only if the property sells—otherwise, the reports are free

✅ Global Buyer Reach & Premium Marketing

Exposure to a vast network of qualified buyers through CoStar, LoopNet, and Ten-X

Complimentary Diamond Ad included ($30,000–$50,000 value) for maximum visibility

👉 Maximize your property's value with a proven platform—contact us today to get started!

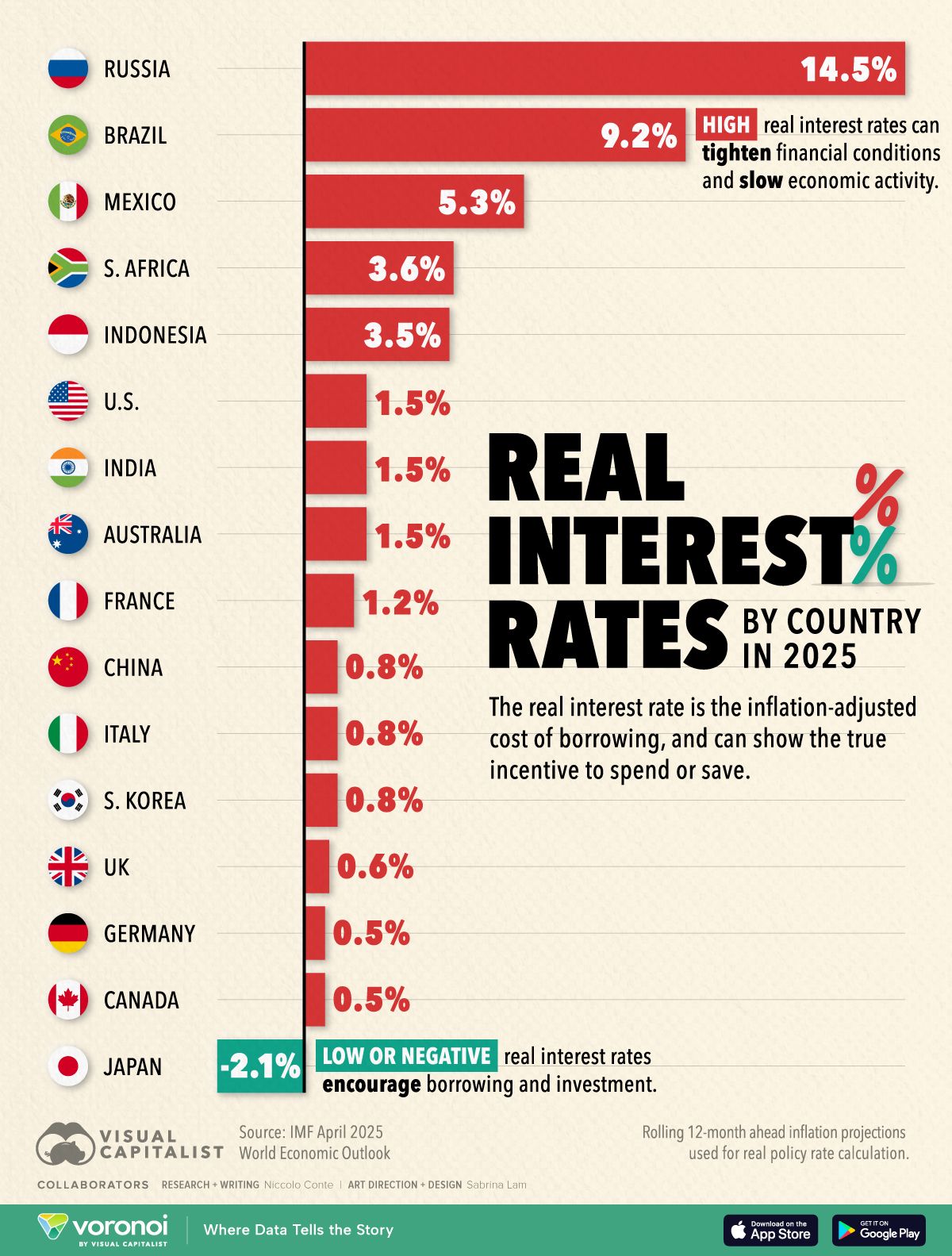

Visual of the Day

Was this email forwarded to you? Don't miss out on this valuable opportunity to elevate your knowledge and expertise in the world of commercial real estate, business brokerage and M&A activity. Sign up for Hughes Commercial Insider today and join our community of commercial real estate professionals committed to success.

To subscribe to Hughes Commercial Insider and stay up-to-date with the latest insights, click here (Subscribe).

Best regards,

Hughes Commercial