🏢 Your Source for Commercial Real Estate, Business Brokerage and M&A Insights

At Hughes Commercial, we deliver actionable insights and strategies at the intersection of commercial real estate (CRE), business brokerage, and mergers & acquisitions (M&A). Each edition unpacks market trends, investment strategies, and deal-making opportunities to help you navigate CRE assets, business transactions, and portfolio growth.

Whether you're exploring income-producing properties or negotiating business deals, our goal is to equip you with the tools to seize opportunities and build lasting success.

The Year-End Moves No One’s Watching

Markets don’t wait — and year-end waits even less.

In the final stretch, money rotates, funds window-dress, tax-loss selling meets bottom-fishing, and “Santa Rally” chatter turns into real tape. Most people notice after the move.

Elite Trade Club is your morning shortcut: a curated selection of the setups that still matter this year — the headlines that move stocks, catalysts on deck, and where smart money is positioning before New Year’s. One read. Five minutes. Actionable clarity.

If you want to start 2026 from a stronger spot, finish 2025 prepared. Join 200K+ traders who open our premarket briefing, place their plan, and let the open come to them.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

Featured Article

Triple Net (NNN) investments are often marketed as “hands-off,” “recession-resistant,” and “easy to manage.” While that’s mostly true, not all NNN deals are created equal—and the difference between a great buy and a painful one usually comes down to understanding the details that many investors overlook.

After reviewing hundreds of NNN assets, here are the five most common (and costly) mistakes investors make—and how to avoid them.

❌ Mistake #1: Focusing Only on the Cap Rate

A high cap rate can look attractive—but it often signals elevated risk.

What investors should ask instead:

Why is the cap rate higher?

Is the tenant’s credit weaker?

Is the lease short?

Is the location tertiary or low-growth?

Smart investors focus on risk-adjusted returns, not headline numbers.

❌ Mistake #2: Ignoring Lease Structure Nuances

Not all NNN leases are truly passive.

Common hidden responsibilities include:

Roof & structure obligations

Parking lot replacement

Environmental or HVAC responsibilities

Insurance deductibles

Before buying, verify whether the lease is:

Absolute NNN: truly hands-off

NNN: passive but with potential capital items

NN (double net): more landlord involvement

This alone can swing your long-term yield dramatically.

❌ Mistake #3: Not Researching Tenant Strength Beyond the Brand

It’s easy to see a national name and assume safety.

But key questions include:

Is the lease corporate or franchisee backed?

How strong is the operator’s unit-level performance?

What is the rent-to-sales ratio?

Are there store closures nationwide?

A great brand does not guarantee a great guarantee.

❌ Mistake #4: Underestimating Location Risk

NNN buyers sometimes ignore real estate fundamentals because the cash flow looks strong.

But underlying dirt matters.

Consider:

Traffic counts

Population growth

Income trends

Competition in the market

Visibility and ingress/egress

Long-term viability of the trade area

Remember: you may own the cash flow today, but you own the real estate forever.

❌ Mistake #5: Overlooking Releasing or Renewal Risk

Even long-term leases eventually expire.

Before buying, you should know:

How likely is the tenant to renew?

What’s the tenant’s historical renewal rate?

Could the next tenant pay the same rent?

Is the property functional for multiple uses?

Investors get burned when they buy based solely on current income—without a clear view of “what happens next.”

✔️ The Best Investors Know This:

Great NNN investing is less about chasing yield and more about understanding:

The tenant

The real estate

The lease

The market

The long-term downside

That’s how you generate the stable, predictable, passive income the NNN world is known for—without surprises.

📬 Final Thought

In a market where STNL and NNN demand continues to rise, the investors who win aren’t the ones who race to close; they’re the ones who ask smarter questions on the front end.

If you want help evaluating a potential NNN acquisition or need a second set of eyes on the lease, just reply. I’m happy to walk through the details with you.

🚀 Fast-Track Your Property Sale with Our 100-Day List-to-Close Solution

Looking to sell your commercial property quickly and efficiently? Hughes Commercial, in partnership with Ten-X, offers a streamlined process to take your property from listed to closed in just 100 days. Here’s how we make it happen:

🔹 Efficient, Low-Risk Selling with Ten-X 🔹

✅ Streamlined Process

45-day targeted marketing campaign

48-hour online bidding event

Non-contingent closing within ~30 days for fast, reliable execution

✅ No Upfront Costs

Sellers pay nothing upfront—Ten-X is compensated by the buyer upon a successful sale

✅ Seller Protection

Set a reserve price and sell only if that price is met, minimizing downside risk

✅ High Certainty of Close

Buyers are prequalified and must provide proof of funds

10% non-refundable earnest money deposit (EMD) required from day one

✅ Comprehensive Due Diligence

Phase I and Property Condition Assessment reports (~$2,200 each) provided upfront

Sellers reimburse Ten-X only if the property sells—otherwise, the reports are free

✅ Global Buyer Reach & Premium Marketing

Exposure to a vast network of qualified buyers through CoStar, LoopNet, and Ten-X

Complimentary Diamond Ad included ($30,000–$50,000 value) for maximum visibility

👉 Maximize your property's value with a proven platform—contact us today to get started!

🔎 Did You Know?

We offer one-time Commercial Real Estate and Business Estimates of Value to help you make smarter decisions.

✅ Nationwide Commercial Real Estate & Business Valuation Reports

Our comprehensive research and data services deliver valuable insights for investors, brokers, and business owners—empowering you to make data-driven decisions with confidence.

💼 Business Estimates of Value

Curious about what your business is worth in today’s market? Our business valuation reports give you a clear understanding of your company’s value—so you can plan your next move with certainty.

🌍 Access Nationwide Commercial Property Data

✔️ Ownership Records & Transaction History – Get detailed property information, including past sales, lease comps, and ownership records for accurate valuations.

✔️ Market Analytics & Insights – Stay ahead with reports on vacancy rates, rental trends, construction activity, and economic forecasts.

✔️ Lease & Tenant Information – Understand tenant portfolios, lease expirations, and key contact details.

📩 Get the Data You Need

Looking for specific insights? Let us know what you need, and we’ll customize a report tailored to your goals.

👉 Contact us today to unlock valuable insights for your next deal!

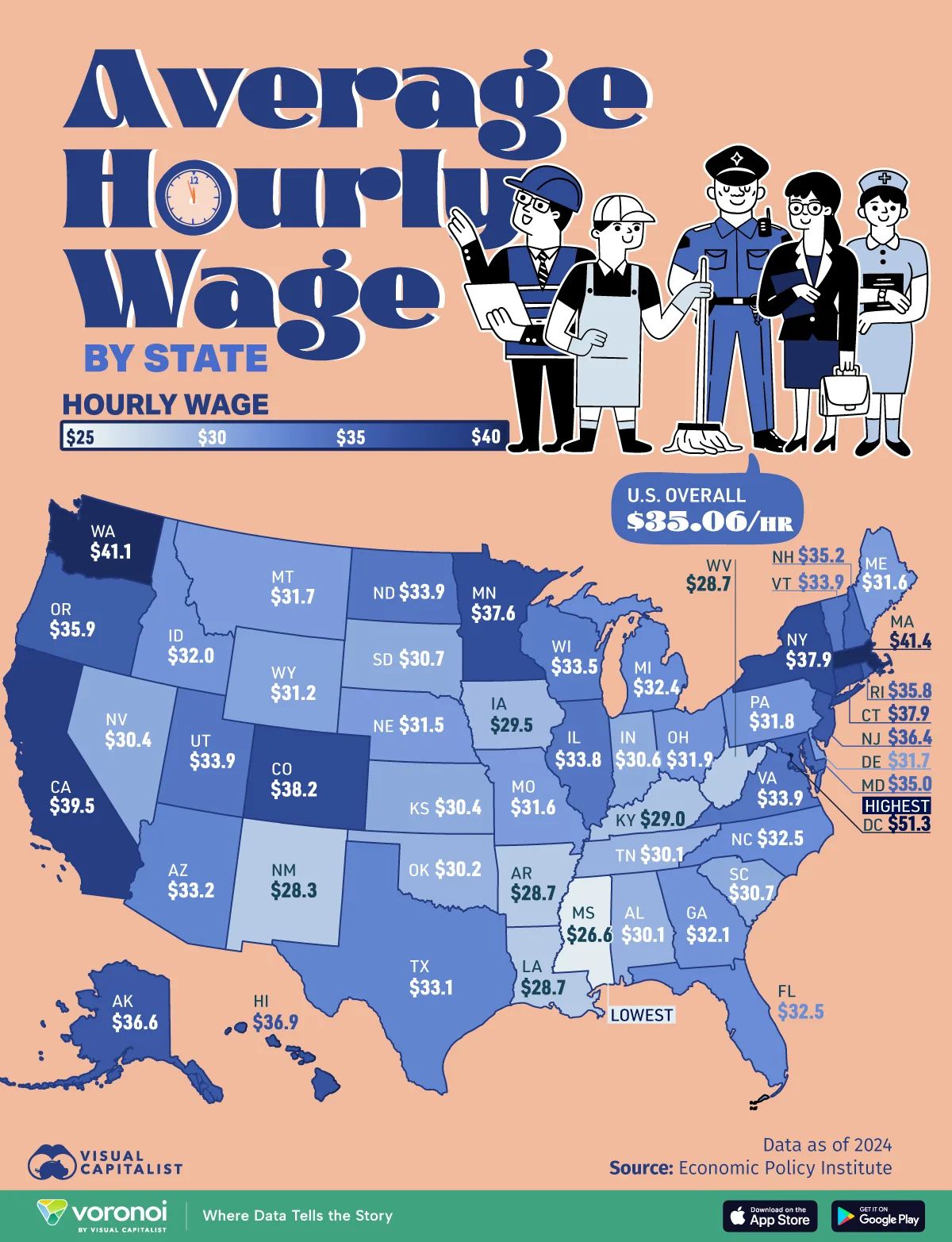

Visual of the Day

Was this email forwarded to you? Don't miss out on this valuable opportunity to elevate your knowledge and expertise in the world of commercial real estate, business brokerage and M&A activity. Sign up for Hughes Commercial Insider today and join our community of commercial real estate professionals committed to success.

To subscribe to Hughes Commercial Insider and stay up-to-date with the latest insights, click here (Subscribe).

Best regards,

Hughes Commercial