🏢 Your Source for Commercial Real Estate, Business Brokerage and M&A Insights

At Hughes Commercial, we deliver actionable insights and strategies at the intersection of commercial real estate (CRE), business brokerage, and mergers & acquisitions (M&A). Each edition unpacks market trends, investment strategies, and deal-making opportunities to help you navigate CRE assets, business transactions, and portfolio growth.

Whether you're exploring income-producing properties or negotiating business deals, our goal is to equip you with the tools to seize opportunities and build lasting success.

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Featured Article

In the world of net lease investing, there’s a structural decision that often gets glossed over—but can massively impact your returns, risk profile, and long-term upside:

Are you buying a fee simple interest or a ground lease position?

The difference matters.

A lot.

Let’s break down what each means—and how to decide what fits your strategy best.

🏗️ What Is Fee Simple Ownership?

Fee simple is the most complete form of real estate ownership. You own the land, the building, and all associated rights.

✅ Full control

✅ Long-term appreciation

✅ More leverage options

Most single-tenant NNN assets are sold fee simple. Investors like the simplicity, security, and long-term wealth-building potential.

🌎 What Is a Ground Lease?

In a ground lease, the investor owns the land only. The tenant—or a separate developer—typically builds and owns the structure but pays you rent for use of the land.

✅ Long-term income stream

✅ Lower maintenance risk

✅ Superior legal protection in default (often senior to leasehold debt)

Many ground leases are “absolute net”, with zero landlord responsibilities—making them appealing for passive income seekers.

But they’re not without caveats.

⚖️ Pros and Cons at a Glance

Structure | Pros | Cons |

|---|---|---|

Fee Simple | Full ownership, appreciation, more control | More responsibility (repairs, capital costs) |

Ground Lease | Passive income, low maintenance, downside protection | Limited upside, long-term control issues |

🚨 Key Risks to Watch For

With Fee Simple:

You're on the hook for property-level issues (even in triple net deals, if they aren’t “absolute”)

You bear the full cost of capital improvements if triggered by lease terms

With Ground Leases:

Reversion risk: At lease maturity, buildings often revert to the landowner—but can become functionally obsolete

Lender limitations: Many lenders won’t finance ground lease positions as favorably

Exit liquidity: Fewer buyers understand or want ground leases, especially with short remaining terms

🧠 Which Should You Choose?

It comes down to your goals.

Want control, appreciation, and flexibility? → Fee Simple

Want mail-box money with minimal headache? → Ground Lease

Chasing yield but okay with complexity and liquidity tradeoffs? → Consider both—with eyes wide open

🎯 Bottom Line

Whether you’re buying a NNN property or considering a long-term income play, understanding the difference between fee simple and ground lease is critical to your investment strategy.

Structure isn’t just legal—it’s financial DNA.

Want help evaluating a potential deal structure?

We work with net lease investors across the country to underwrite and structure deals that align with your long-term goals.

🚀 Fast-Track Your Property Sale with Our 100-Day List-to-Close Solution

Looking to sell your commercial property quickly and efficiently? Hughes Commercial, in partnership with Ten-X, offers a streamlined process to take your property from listed to closed in just 100 days. Here’s how we make it happen:

🔹 Efficient, Low-Risk Selling with Ten-X 🔹

✅ Streamlined Process

45-day targeted marketing campaign

48-hour online bidding event

Non-contingent closing within ~30 days for fast, reliable execution

✅ No Upfront Costs

Sellers pay nothing upfront—Ten-X is compensated by the buyer upon a successful sale

✅ Seller Protection

Set a reserve price and sell only if that price is met, minimizing downside risk

✅ High Certainty of Close

Buyers are prequalified and must provide proof of funds

10% non-refundable earnest money deposit (EMD) required from day one

✅ Comprehensive Due Diligence

Phase I and Property Condition Assessment reports (~$2,200 each) provided upfront

Sellers reimburse Ten-X only if the property sells—otherwise, the reports are free

✅ Global Buyer Reach & Premium Marketing

Exposure to a vast network of qualified buyers through CoStar, LoopNet, and Ten-X

Complimentary Diamond Ad included ($30,000–$50,000 value) for maximum visibility

👉 Maximize your property's value with a proven platform—contact us today to get started!

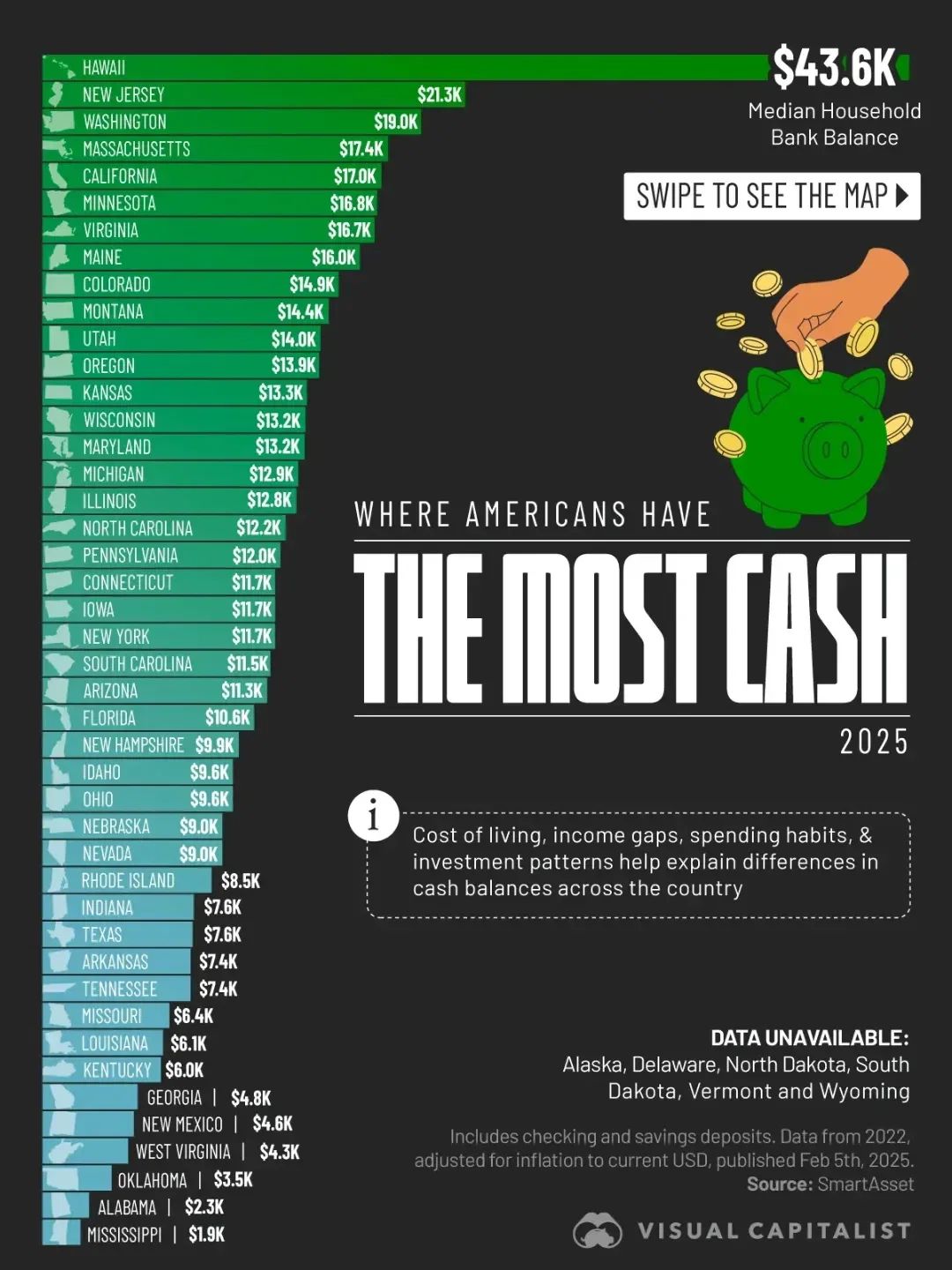

Visual of the Day

Was this email forwarded to you? Don't miss out on this valuable opportunity to elevate your knowledge and expertise in the world of commercial real estate, business brokerage and M&A activity. Sign up for Hughes Commercial Insider today and join our community of commercial real estate professionals committed to success.

To subscribe to Hughes Commercial Insider and stay up-to-date with the latest insights, click here (Subscribe).

Best regards,

Hughes Commercial