🏢 Your Source for Commercial Real Estate, Business Brokerage and M&A Insights

At Hughes Commercial, we deliver actionable insights and strategies at the intersection of commercial real estate (CRE), business brokerage, and mergers & acquisitions (M&A). Each edition unpacks market trends, investment strategies, and deal-making opportunities to help you navigate CRE assets, business transactions, and portfolio growth.

Whether you're exploring income-producing properties or negotiating business deals, our goal is to equip you with the tools to seize opportunities and build lasting success.

Looking for unbiased, fact-based news? Join 1440 today.

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Featured Article

Energy upgrades like EV charging stations and rooftop solar panels are having a moment in commercial real estate. But for owners and investors, the key question isn’t what’s trending—it’s what pencils.

In this issue, we break down the real ROI, tenant demand, and incentive landscape behind EV chargers and solar installations. Here’s what you need to know:

⚡ EV Chargers: Amenity or Asset?

Tenant Demand: EV adoption is growing fast—especially among national retailers, healthcare operators, and Class A office users looking to future-proof their locations. Many see EV chargers as a sign of modernity and ESG alignment.

ROI Reality: Without subsidies or high utilization, EV chargers alone rarely drive meaningful cash flow. Level 2 chargers may cost $3,000–$7,000 per port installed; DC fast chargers can hit $50,000+. ROI depends heavily on tenant agreements and usage levels.

Best Use Case: Treat chargers as an amenity that attracts quality tenants, not as a standalone profit center—unless you’re in high-traffic retail or hospitality where you can capture dwell time.

☀️ Solar Panels: Lower Bills, Higher Complexity

Tenant Benefit: Solar can reduce operating expenses, which boosts NOI in NNN deals where landlords control the roof. But split incentives (who pays the bill vs. who gets the savings) often complicate adoption.

ROI Factors:

Federal Investment Tax Credit (ITC): 30% credit through 2032

Accelerated Depreciation (MACRS): Accelerate cost recovery

Utility Incentives: Vary widely by state and utility

Best Use Case: Owner-occupied or gross-leased industrial/retail buildings in high-sun states like California, Texas, or Arizona. Bonus points if paired with a long-term PPA (power purchase agreement) or community solar program.

🚨 Watch the Hype

Not every energy upgrade makes financial sense. Here are a few pitfalls to avoid:

Overbuilding chargers without demand forecasting

Assuming solar adds value in leaseback deals (it depends on lease terms)

Neglecting maintenance, utility interconnection delays, and system degradation

🧠 Bottom Line

Energy upgrades can add value—but only when aligned with tenant needs, incentives, and long-term asset plans.

If you're underwriting a deal or exploring ways to boost NOI, these upgrades deserve a second look—but don’t get swept up in the ESG buzz without doing the math.

Need help evaluating an energy upgrade in your CRE portfolio?

Let’s connect—energy is just another lever in smart real estate strategy.

—

Hughes Commercial | Real Estate & Business Advisory

🚀 Fast-Track Your Property Sale with Our 100-Day List-to-Close Solution

Looking to sell your commercial property quickly and efficiently? Hughes Commercial, in partnership with Ten-X, offers a streamlined process to take your property from listed to closed in just 100 days. Here’s how we make it happen:

🔹 Efficient, Low-Risk Selling with Ten-X 🔹

✅ Streamlined Process

45-day targeted marketing campaign

48-hour online bidding event

Non-contingent closing within ~30 days for fast, reliable execution

✅ No Upfront Costs

Sellers pay nothing upfront—Ten-X is compensated by the buyer upon a successful sale

✅ Seller Protection

Set a reserve price and sell only if that price is met, minimizing downside risk

✅ High Certainty of Close

Buyers are prequalified and must provide proof of funds

10% non-refundable earnest money deposit (EMD) required from day one

✅ Comprehensive Due Diligence

Phase I and Property Condition Assessment reports (~$2,200 each) provided upfront

Sellers reimburse Ten-X only if the property sells—otherwise, the reports are free

✅ Global Buyer Reach & Premium Marketing

Exposure to a vast network of qualified buyers through CoStar, LoopNet, and Ten-X

Complimentary Diamond Ad included ($30,000–$50,000 value) for maximum visibility

👉 Maximize your property's value with a proven platform—contact us today to get started!

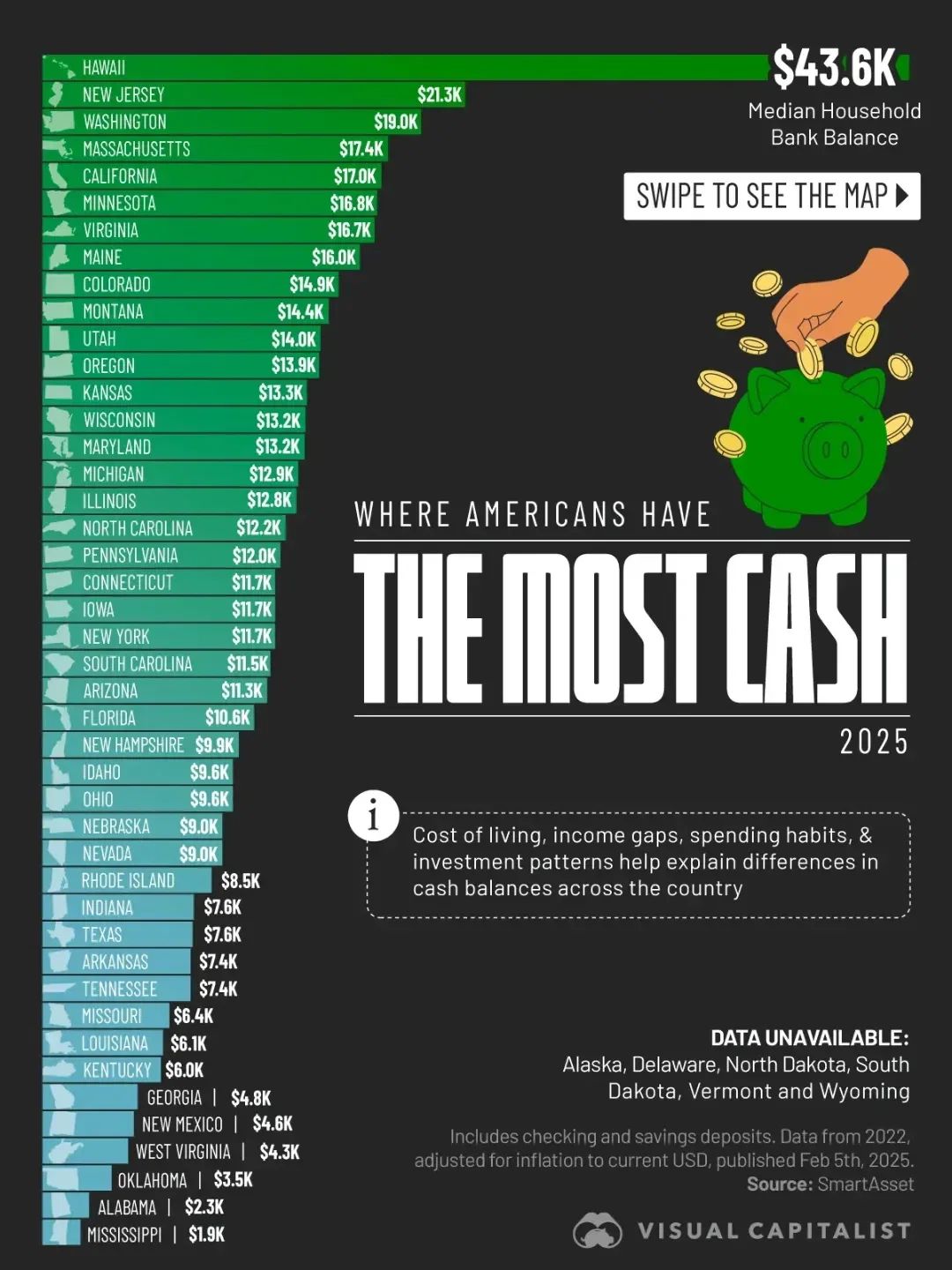

Visual of the Day

Was this email forwarded to you? Don't miss out on this valuable opportunity to elevate your knowledge and expertise in the world of commercial real estate, business brokerage and M&A activity. Sign up for Hughes Commercial Insider today and join our community of commercial real estate professionals committed to success.

To subscribe to Hughes Commercial Insider and stay up-to-date with the latest insights, click here (Subscribe).

Best regards,

Hughes Commercial