🏢 Your Source for Commercial Real Estate, Business Brokerage and M&A Insights

At Hughes Commercial, we deliver actionable insights and strategies at the intersection of commercial real estate (CRE), business brokerage, and mergers & acquisitions (M&A). Each edition unpacks market trends, investment strategies, and deal-making opportunities to help you navigate CRE assets, business transactions, and portfolio growth.

Whether you're exploring income-producing properties or negotiating business deals, our goal is to equip you with the tools to seize opportunities and build lasting success.

Find out why 1M+ professionals read Superhuman AI daily.

In 2 years you will be working for AI

Or an AI will be working for you

Here's how you can future-proof yourself:

Join the Superhuman AI newsletter – read by 1M+ people at top companies

Master AI tools, tutorials, and news in just 3 minutes a day

Become 10X more productive using AI

Join 1,000,000+ pros at companies like Google, Meta, and Amazon that are using AI to get ahead.

Featured Article

In today’s market, growth isn’t just about buying more real estate—it’s about buying the businesses that operate on it.

From fuel distributors buying c-stores, to dental groups acquiring practices (and the buildings they lease), one strategy is gaining momentum across industries: roll-ups and vertical integrations.

If you own or invest in income-producing real estate, here’s why you need to pay attention.

🔁 What’s a Roll-Up?

A roll-up is when an investor or company acquires multiple businesses in the same industry to gain scale, increase valuation, and consolidate operations.

This strategy works well when:

There are lots of fragmented owner-operators

Margins improve with size

Brand equity grows with scale

Operational systems can be standardized

Real estate becomes a leveraged advantage—whether owned outright or under long-term lease.

🏭 What’s Vertical Integration?

Vertical integration means acquiring companies upstream or downstream in your value chain.

Examples:

A fuel distributor buys convenience stores.

A logistics firm acquires warehouses and trucks.

A coffee roaster buys cafes.

A commercial landscaper buys the nursery and supply yard.

In every case, the real estate isn’t just an investment—it’s a competitive moat.

🧱 Why CRE Is a Critical Piece

Here’s the kicker: in many of these strategies, the real estate is just as valuable as the business—sometimes more.

Smart buyers structure deals where they:

Acquire both the business and the building

Sell the real estate and keep the business (or vice versa)

Use the lease to stabilize operations and future-proof growth

This opens the door to:

Sale-leasebacks

1031 exchanges

Owner-occupied financing

Increased EBITDA through rent control

📈 What This Means for Owners

If you’re:

A business owner sitting on valuable real estate

A landlord with a tenant who wants to exit

An investor interested in more control and cash flow…

You may be sitting on an unrealized roll-up opportunity.

These deals create layered value by combining:

Operating income (business)

Passive income (real estate)

Strategic growth (M&A)

Final Thought:

CRE and M&A are no longer separate playbooks—they’re converging. The best deals in 2025 and beyond won’t be one or the other…they’ll be both.

—

Thinking about buying, selling, or structuring a deal that involves both real estate and a business?

We can help you model it, market it, or make it happen.

—

Hughes Commercial | Real Estate, M&A & Business Advisory

🚀 Fast-Track Your Property Sale with Our 100-Day List-to-Close Solution

Looking to sell your commercial property quickly and efficiently? Hughes Commercial, in partnership with Ten-X, offers a streamlined process to take your property from listed to closed in just 100 days. Here’s how we make it happen:

🔹 Efficient, Low-Risk Selling with Ten-X 🔹

✅ Streamlined Process

45-day targeted marketing campaign

48-hour online bidding event

Non-contingent closing within ~30 days for fast, reliable execution

✅ No Upfront Costs

Sellers pay nothing upfront—Ten-X is compensated by the buyer upon a successful sale

✅ Seller Protection

Set a reserve price and sell only if that price is met, minimizing downside risk

✅ High Certainty of Close

Buyers are prequalified and must provide proof of funds

10% non-refundable earnest money deposit (EMD) required from day one

✅ Comprehensive Due Diligence

Phase I and Property Condition Assessment reports (~$2,200 each) provided upfront

Sellers reimburse Ten-X only if the property sells—otherwise, the reports are free

✅ Global Buyer Reach & Premium Marketing

Exposure to a vast network of qualified buyers through CoStar, LoopNet, and Ten-X

Complimentary Diamond Ad included ($30,000–$50,000 value) for maximum visibility

👉 Maximize your property's value with a proven platform—contact us today to get started!

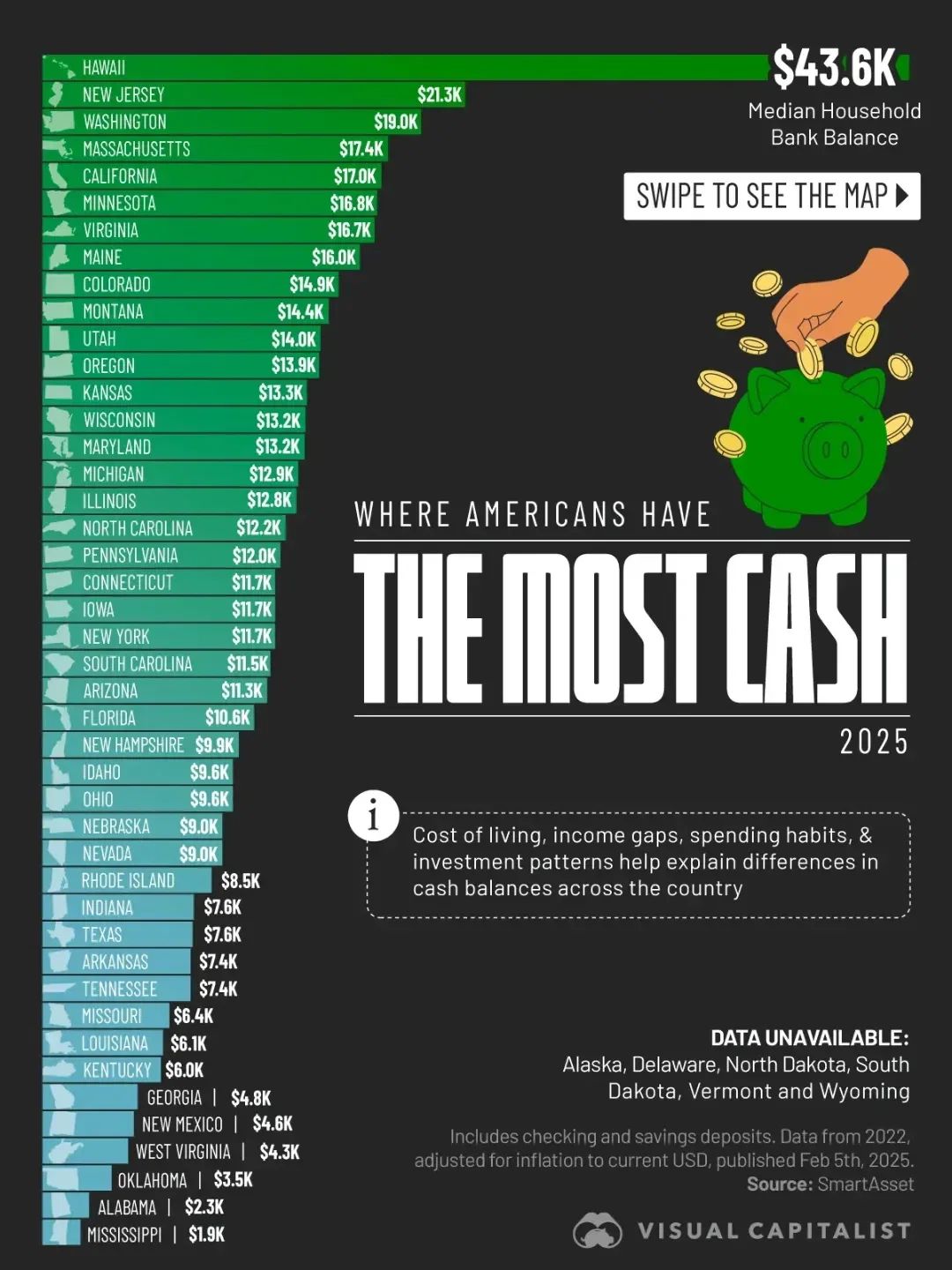

Visual of the Day

Was this email forwarded to you? Don't miss out on this valuable opportunity to elevate your knowledge and expertise in the world of commercial real estate, business brokerage and M&A activity. Sign up for Hughes Commercial Insider today and join our community of commercial real estate professionals committed to success.

To subscribe to Hughes Commercial Insider and stay up-to-date with the latest insights, click here (Subscribe).

Best regards,

Hughes Commercial