🏢 Your Source for Commercial Real Estate, Business Brokerage and M&A Insights

At Hughes Commercial, we deliver actionable insights and strategies at the intersection of commercial real estate (CRE), business brokerage, and mergers & acquisitions (M&A). Each edition unpacks market trends, investment strategies, and deal-making opportunities to help you navigate CRE assets, business transactions, and portfolio growth.

Whether you're exploring income-producing properties or negotiating business deals, our goal is to equip you with the tools to seize opportunities and build lasting success.

The easiest way to stay business-savvy.

There’s a reason over 4 million professionals start their day with Morning Brew. It’s business news made simple—fast, engaging, and actually enjoyable to read.

From business and tech to finance and global affairs, Morning Brew covers the headlines shaping your work and your world. No jargon. No fluff. Just the need-to-know information, delivered with personality.

It takes less than 5 minutes to read, it’s completely free, and it might just become your favorite part of the morning. Sign up now and see why millions of professionals are hooked.

Featured Article

In commercial real estate, cap rates are the pulse of the market—a direct reflection of investor sentiment, risk appetite, and cost of capital.

And right now?

That pulse is jumping.

Whether you're a net lease investor, 1031 buyer, or private equity-backed group, it’s critical to understand where cap rates are headed—and what’s driving the shift.

Let’s take a look.

📈 Quick Cap Rate Refresher

Cap Rate = Net Operating Income ÷ Purchase Price

Higher cap rate = lower price relative to income

Lower cap rate = higher price, more competitive demand

Cap rates expand when rates rise, risk increases, or investor demand weakens.

They compress when money is cheap and assets are hot.

🗺️ Cap Rate Movement by Region (2023–2025 YTD)

Region | 2023 Avg Cap | 2025 Avg Cap (YTD) | Trend |

|---|---|---|---|

West Coast | 5.0% | 5.6% | ⬆️ Rising |

Southeast | 5.2% | 5.3% | ➡️ Holding |

Midwest | 6.0% | 6.2% | ⬆️ Slight Rise |

Northeast | 5.1% | 5.4% | ⬆️ Gradual Rise |

Texas/Southwest | 5.5% | 5.5% | ➡️ Stable |

👉 Biggest spread between coastal urban markets (lower cap, higher price) and secondary/tertiary markets in the Midwest and South.

🏬 Cap Rate Trends by Asset Type

Asset Class | 2023 Cap | 2025 Cap (YTD) | Notes |

|---|---|---|---|

QSR Net Lease (NNN) | 5.0% | 5.5% | Operators facing margin pressure & labor costs |

Pharmacy (NNN) | 5.3% | 6.0% | Slower growth + corporate uncertainty |

Industrial (Core) | 4.8% | 5.1% | Cooling from record low caps |

Office (Suburban) | 7.2% | 8.0%+ | Cap risk rising fast |

Convenience Store / Fuel | 5.8% | 6.1% | Holding steady with strong tenant demand |

Medical Office | 5.6% | 5.9% | Still in favor, but slowing slightly |

💡 What’s Driving the Shift?

Higher interest rates: Cap rates must rise to reflect increased cost of debt

Risk repricing: More scrutiny on tenant credit, lease rollover risk, and location quality

Buyers are patient: Fewer aggressive 1031 buyers, more disciplined underwriting

Asset bifurcation: Best-in-class assets still command premiums, but B/C properties are seeing steep discounts

🔮 What’s Next?

Expect continued softening in cap rates for most sectors, especially where lease terms are short or tenant risk is elevated.

But here’s the nuance:

Absolute NNN with top-tier tenants in growth markets? Still trading aggressively.

Leases under 5 years, or in saturated markets? Significant cap expansion.

Value-add or redevelopment plays? Getting more attention from opportunistic buyers.

🧠 Bottom Line

Cap rates are more than a math formula—they’re a real-time read on market sentiment.

And in today’s market, understanding cap rate movement by region, asset type, and lease structure gives you a critical edge.

Need help pricing a deal—or stress-testing a sale?

Let’s run the numbers together.

🚀 Fast-Track Your Property Sale with Our 100-Day List-to-Close Solution

Looking to sell your commercial property quickly and efficiently? Hughes Commercial, in partnership with Ten-X, offers a streamlined process to take your property from listed to closed in just 100 days. Here’s how we make it happen:

🔹 Efficient, Low-Risk Selling with Ten-X 🔹

✅ Streamlined Process

45-day targeted marketing campaign

48-hour online bidding event

Non-contingent closing within ~30 days for fast, reliable execution

✅ No Upfront Costs

Sellers pay nothing upfront—Ten-X is compensated by the buyer upon a successful sale

✅ Seller Protection

Set a reserve price and sell only if that price is met, minimizing downside risk

✅ High Certainty of Close

Buyers are prequalified and must provide proof of funds

10% non-refundable earnest money deposit (EMD) required from day one

✅ Comprehensive Due Diligence

Phase I and Property Condition Assessment reports (~$2,200 each) provided upfront

Sellers reimburse Ten-X only if the property sells—otherwise, the reports are free

✅ Global Buyer Reach & Premium Marketing

Exposure to a vast network of qualified buyers through CoStar, LoopNet, and Ten-X

Complimentary Diamond Ad included ($30,000–$50,000 value) for maximum visibility

👉 Maximize your property's value with a proven platform—contact us today to get started!

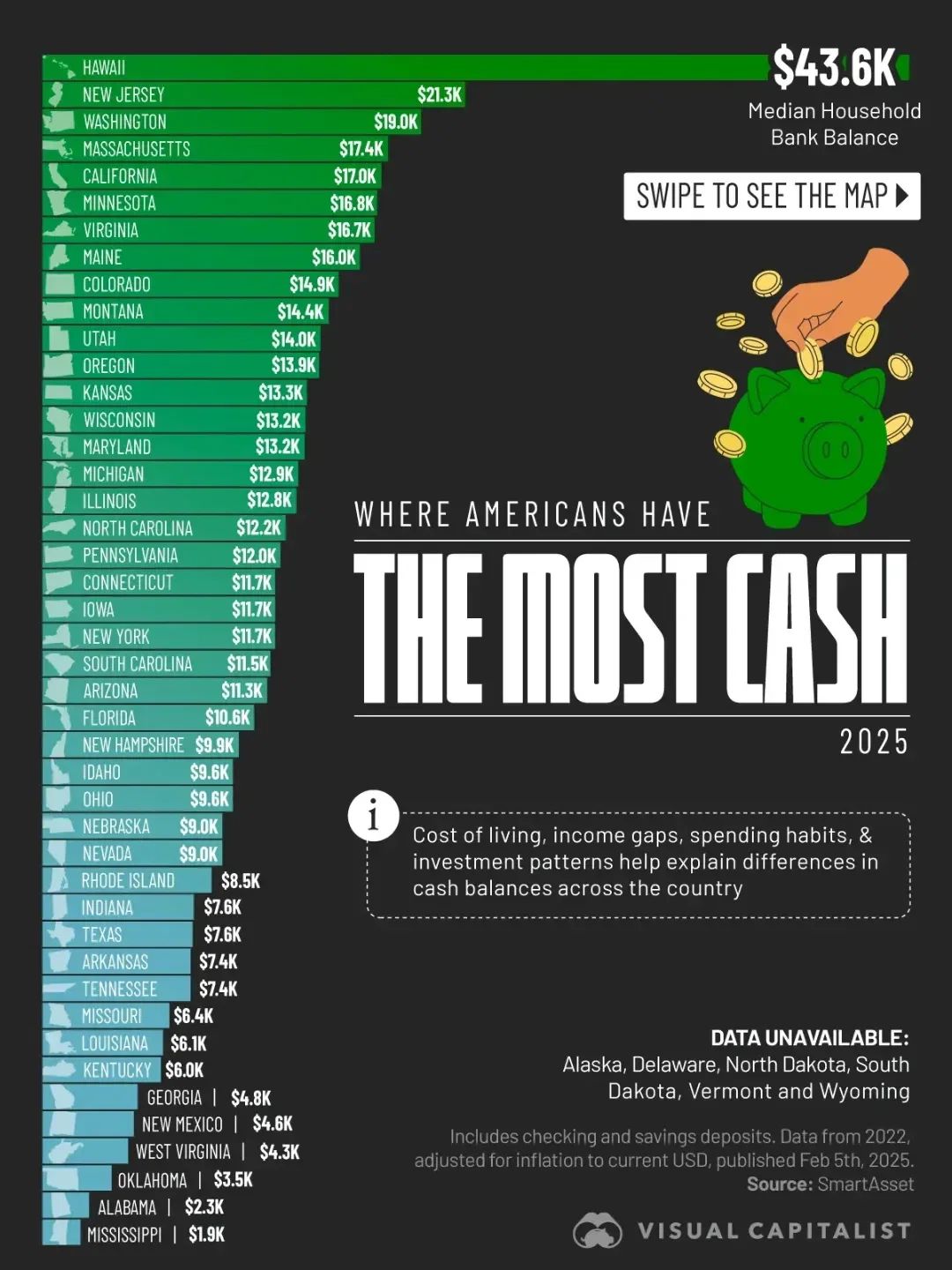

Visual of the Day

Was this email forwarded to you? Don't miss out on this valuable opportunity to elevate your knowledge and expertise in the world of commercial real estate, business brokerage and M&A activity. Sign up for Hughes Commercial Insider today and join our community of commercial real estate professionals committed to success.

To subscribe to Hughes Commercial Insider and stay up-to-date with the latest insights, click here (Subscribe).

Best regards,

Hughes Commercial