🏢 Your Source for Commercial Real Estate, Business Brokerage and M&A Insights

At Hughes Commercial, we deliver actionable insights and strategies at the intersection of commercial real estate (CRE), business brokerage, and mergers & acquisitions (M&A). Each edition unpacks market trends, investment strategies, and deal-making opportunities to help you navigate CRE assets, business transactions, and portfolio growth.

Whether you're exploring income-producing properties or negotiating business deals, our goal is to equip you with the tools to seize opportunities and build lasting success.

The Supply Chain Crisis Is Escalating — But This Tech Startup Keeps Winning

Global supply chain chaos is intensifying. Major retailers warn of holiday shortages, and tech giants are slashing forecasts as parts dry up.

But while others scramble, one smart home innovator is thriving.

Their strategic move to manufacturing outside China has kept production running smoothly — driving 200% year-over-year growth, even as the industry stalls.

This foresight is no accident. The same leadership team that saw the supply chain storm coming has already expanded into over 120 BestBuy locations, with talks underway to add Walmart and Home Depot.

At just $1.90 per share, this resilient tech startup offers rare stability in uncertain times. As investors flee vulnerable companies, this window is closing fast.

Past performance is not indicative of future results. Email may contain forward-looking statements. See US Offering for details. Informational purposes only.

Featured Article

📊 What the Latest CoStar Report Tells Us About Net Lease Retail

CoStar just dropped their latest market update, and if you’re in the net lease retail space, there’s a lot to unpack.

While the headlines are all about office vacancies and multifamily deliveries, the net lease retail sector continues to quietly prove its resilience—and even show signs of strength in places most aren’t watching.

Let’s dig into the key takeaways—and what they actually mean for investors.

🧱 🏪 Single Tenant Retail: Holding Strong

According to CoStar’s data:

Vacancy for single-tenant retail remains near historic lows, hovering between 3.8–4.2% nationally

Rents continue to inch upward, with year-over-year growth in the 2.5–4% range, depending on the market

New construction starts are down, which limits future supply—a bullish sign for landlords

Translation?

Even as consumer behavior shifts and economic uncertainty lingers, credit tenants in solid locations are sticking around—and paying more.

💵 Cap Rates Are Flattening—But Not Crashing

Cap rates for net lease retail have crept up slightly—mostly due to the rising interest rate environment—but they’re not blowing out like some feared:

Q1 average cap for national STNL retail: 6.10%

Q1 2023 average cap: 5.80%

Delta: +30 bps year-over-year

What’s more interesting is the spread between tenant types:

Corporate tenants: 5.5%–6.0%

Franchisee or private credit: 6.5%–7.25%

Tertiary market deals with short lease terms: pushing 8%+

Flight to quality is real—and it's showing up in pricing.

📍 Secondary Markets Are Quietly Winning

CoStar reports elevated investor activity in select secondary and tertiary markets—especially in the Southeast, Midwest, and Mountain West regions.

Why?

Better pricing

More favorable tax environments

Lower competition from institutional buyers

Investors are waking up to the idea that a Taco Bell in Alabama with a 15-year corporate lease may outperform a Walgreens in Chicago with 3 years left.

🔎 Lease Structure Is Under the Microscope

More than ever, investors are zeroing in on lease details—especially:

Who covers roof, structure, HVAC?

Are there hidden landlord responsibilities?

What’s the actual NOI, after reserves?

The CoStar data hints at a more discerning buyer pool, with smart money demanding transparency and clean lease terms. It’s no longer just about the brand on the sign—it’s about the real estate and the risk behind it.

🧠 Bottom Line

The net lease retail sector is not immune to macro pressure, but it’s proving to be durable, cash-flowing, and stable—especially when compared to other commercial asset classes.

CoStar’s report confirms what many of us are seeing in real time:

Net lease retail is becoming a safe haven for yield-hungry investors who want simplicity and predictability.

Now is a good time to re-evaluate your deal criteria. The opportunities are still there—you just have to know where to look (and what to avoid).

Want help breaking down the numbers on your next STNL deal?

Let’s connect. We live and breathe this space.

🚀 Fast-Track Your Property Sale with Our 100-Day List-to-Close Solution

Looking to sell your commercial property quickly and efficiently? Hughes Commercial, in partnership with Ten-X, offers a streamlined process to take your property from listed to closed in just 100 days. Here’s how we make it happen:

🔹 Efficient, Low-Risk Selling with Ten-X 🔹

✅ Streamlined Process

45-day targeted marketing campaign

48-hour online bidding event

Non-contingent closing within ~30 days for fast, reliable execution

✅ No Upfront Costs

Sellers pay nothing upfront—Ten-X is compensated by the buyer upon a successful sale

✅ Seller Protection

Set a reserve price and sell only if that price is met, minimizing downside risk

✅ High Certainty of Close

Buyers are prequalified and must provide proof of funds

10% non-refundable earnest money deposit (EMD) required from day one

✅ Comprehensive Due Diligence

Phase I and Property Condition Assessment reports (~$2,200 each) provided upfront

Sellers reimburse Ten-X only if the property sells—otherwise, the reports are free

✅ Global Buyer Reach & Premium Marketing

Exposure to a vast network of qualified buyers through CoStar, LoopNet, and Ten-X

Complimentary Diamond Ad included ($30,000–$50,000 value) for maximum visibility

👉 Maximize your property's value with a proven platform—contact us today to get started!

Smarter Growth for DTC Brands on Amazon

Ad spend keeps climbing. ROAS? Not so much.

The smartest Amazon sellers aren’t spending more—they’re spending smarter.

The Affiliate Shift Calculator models what could happen if you reallocated a portion of your ad budget into affiliate marketing.

Built for sellers doing $5M+ on Amazon.

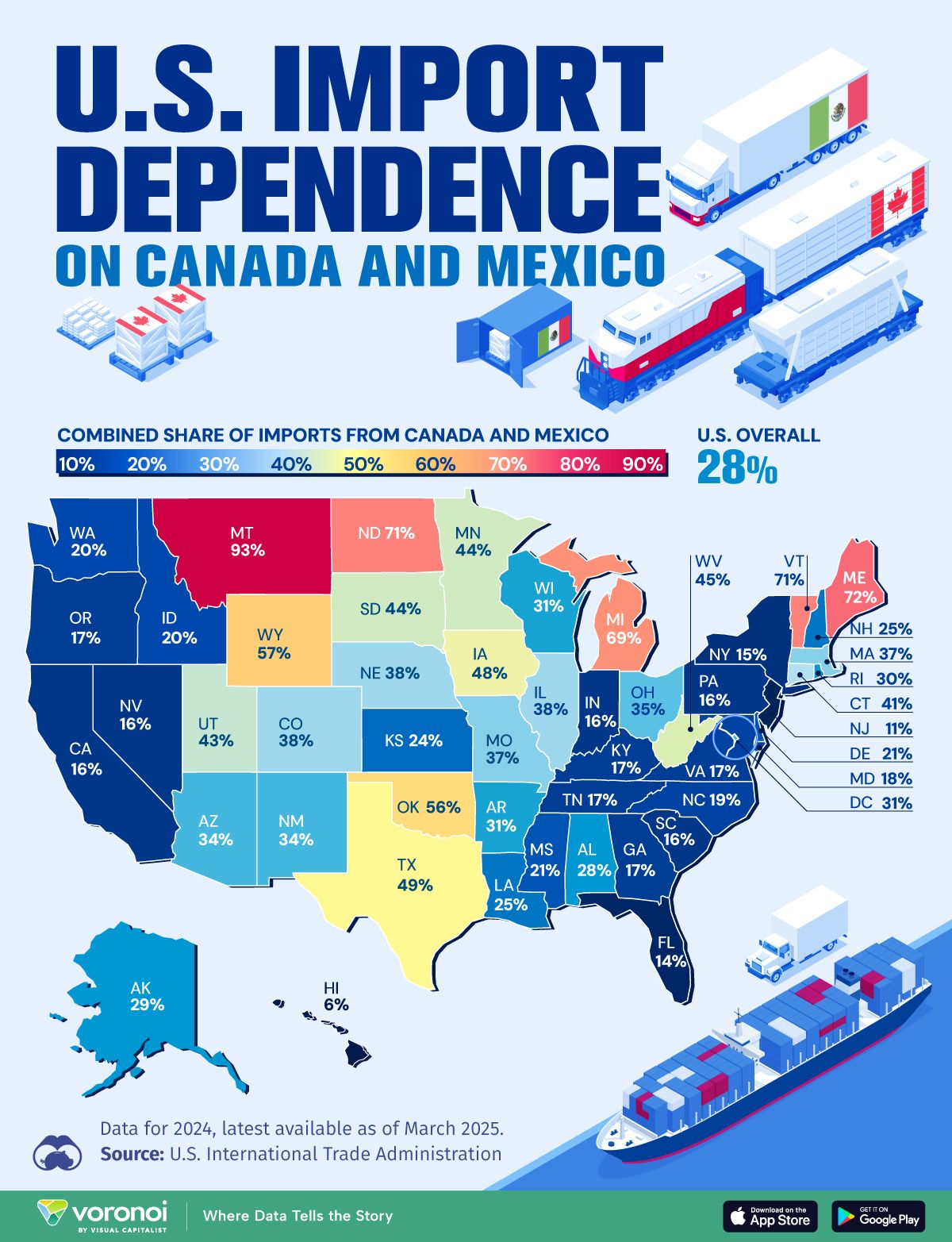

Visual of the Day

Was this email forwarded to you? Don't miss out on this valuable opportunity to elevate your knowledge and expertise in the world of commercial real estate, business brokerage and M&A activity. Sign up for Hughes Commercial Insider today and join our community of commercial real estate professionals committed to success.

To subscribe to Hughes Commercial Insider and stay up-to-date with the latest insights, click here (Subscribe).

Best regards,

Hughes Commercial