🏢 Your Source for Triple Net (NNN) Investment Property Insights

Hello NNN Enthusiasts!

Welcome to Hughes CRE Insider, your FREE go-to source for the latest insights, trends, and updates in the world of Triple Net (NNN) commercial investment properties. Whether you're a seasoned commercial real estate broker or an owner/investor looking to dive into the world of NNN properties, our newsletter is tailored to provide you with valuable knowledge and resources to enhance your expertise and success in this lucrative sector.

We explain the latest business, finance, and tech news with visuals and data. 📊

All in one free newsletter that takes < 5 minutes to read. 🗞

Save time and become more informed today.👇

Featured Article

Triple Net Lease Structures: Exploring Variations and Implications

Welcome to our latest edition focusing on Triple Net Lease (NNN) structures – a fundamental aspect of commercial real estate investing. Whether you're a seasoned investor or a budding enthusiast, understanding the nuances of NNN leases can significantly impact your investment strategy and success.

What is a Triple Net Lease?

A Triple Net Lease, commonly referred to as an NNN lease, is a type of commercial lease agreement where the tenant is responsible for paying not only rent but also all operating expenses associated with the property. These expenses typically include property taxes, insurance, and maintenance costs, hence the term "triple net."

Variations in NNN Lease Structures

While the basic premise of a Triple Net Lease remains consistent, variations exist within this structure, each carrying its own set of implications for both landlords and tenants:

1. Absolute NNN Lease: In an absolute NNN lease, tenants assume full responsibility for all operating expenses, including structural repairs and replacements. Landlords receive a predictable income stream, often with minimal management involvement.

2. NN Lease (Double Net Lease): In an NN lease, tenants are responsible for property taxes and insurance, while landlords retain responsibility for structural repairs and maintenance. This structure provides a balance of responsibilities between landlords and tenants, making it a popular choice for certain commercial properties.

3. NNN Lease with Expense Stops: Some NNN leases incorporate expense stops, which cap the landlord's financial responsibility for operating expenses. Tenants are responsible for expenses exceeding the agreed-upon threshold, providing landlords with a degree of cost predictability.

4. NNN Lease with Percentage Rent: In certain cases, NNN leases may include provisions for percentage rent, where tenants pay a base rent plus a percentage of their gross sales. This structure aligns tenant performance with landlord revenue and is often utilized in retail properties.

Implications for Owners, Investors, and CRE Brokers

Understanding the variations in NNN lease structures is crucial for owners, investors, and commercial real estate (CRE) brokers alike:

- Risk Management: Different NNN lease structures allocate risks differently between landlords and tenants. Investors should assess the level of risk they are willing to undertake and select lease structures accordingly.

- Income Stability: Absolute NNN leases provide owners with a steady income stream, while leases with expense stops or percentage rent may offer potential upside but come with increased variability.

- Asset Valuation: NNN lease structures can influence property valuations. Properties with long-term absolute NNN leases often command premium prices due to their stability, while those with shorter-term leases or more tenant responsibilities may be subject to greater volatility.

- Market Dynamics: CRE brokers play a vital role in navigating the complexities of NNN lease structures for their clients. Understanding market trends and tenant preferences can inform strategic decision-making and maximize value for investors.

In conclusion, the nuances of Triple Net Lease structures have far-reaching implications for owners, investors, and CRE brokers. By understanding the variations within NNN leases and their respective implications, stakeholders can make informed decisions to optimize their commercial real estate portfolios.

NNN Property Spotlight

Presenting a prime commercial property at 1210 New Garden Road, Greensboro NC, this immaculate medical building offers an outstanding opportunity, particularly suitable for 1031 exchanges. Housing a single, stable medical tenant with a substantial practice across multiple locations, this facility was purpose-built for them in 2014, with an expansion completed in 2017. Potential for significant rental increases and escalations upon lease renewal, making it an attractive investment prospect. The current triple net lease generates $341,508 annually, with escalations of 1.5% per year. Furthermore, the lease terms offer room for lease renewal negotiation, presenting a favorable chance to enhance both rent and annual escalations, capitalizing on CPI growth. The property boasts a recent upgrade, with all rooftop HVAC units replaced in 2019 due to hail damage. With a solid, long-term tenant, a modern brick building, and a strategic location, priced at $5,950,000, this offering represents an excellent 1031 replacement opportunity.

Industry News Roundup

Stay up to date with the latest news and developments in the triple net (NNN) industry with our curated roundup of headlines from around the web.

-A Mild Net Lease Cap Increase Is Worse Than It Looks (Read More)

-On Track to $2B in Net Lease Deals (Read More)

-EV Charging Vendor Looks to Sale-Leaseback Financing (Read More)

-Papa Johns to add 50 new stores through new agreement (Read More)

-Walmart Health plans big expansion in Texas (Read More)

NNN Tenant Profile

Tenant Description

Bojangles' stands out as a quick-service restaurant (QSR) renowned for its unique flavors, top-tier scratch-made products, and vibrant restaurant ambiance coupled with warm hospitality.

In the net lease realm, Bojangles' emerges as a highly sought-after tenant. Its standalone establishments typically span 3,500 to 3,800 square feet and occupy plots of land ranging from 0.8 to 1.5 acres. Bojangles' net lease agreements offer investors a lucrative, hassle-free investment opportunity, with landlords shouldering zero responsibilities. Typically, lease terms extend to 15 years under a triple net (NNN) structure, accompanied by 2-4 five-year renewal options, featuring rent escalations of 7-10% every five years. Additionally, some leases incorporate annual rental adjustments, typically ranging from 1.25% to 1.5%.

Founded in Charlotte, North Carolina in 1977, Bojangles' has carved its niche as a thriving restaurant operator and franchisor committed to delivering authentic Southern cuisine. Anchored by its signature "chicken 'n biscuits," Bojangles' menu has remained steadfast over the years, garnering a devoted fanbase. Renowned for its freshly baked biscuits every 20 minutes, succulent bone-in fried chicken, and renowned sweet tea, Bojangles' has cemented its status as an iconic brand.

With a widespread presence across eleven states and Washington, DC, Bojangles' boasts 316 company-operated restaurants and 443 franchised outlets. Its footprint is most prominent in the Southeast and Mid-Atlantic regions, encompassing states like North Carolina, South Carolina, Georgia, and Virginia, among others. Eyeing further expansion, Bojangles' identifies the mid-south as a prime "area of opportunity."

In a significant development, on January 28, 2019, Bojangles' announced its acquisition by Durational Capital Management and the Jordan Company, marking a new chapter while retaining its autonomy as a privately-held entity. The company reaffirmed its commitment to its roots, remaining headquartered in Charlotte, North Carolina.

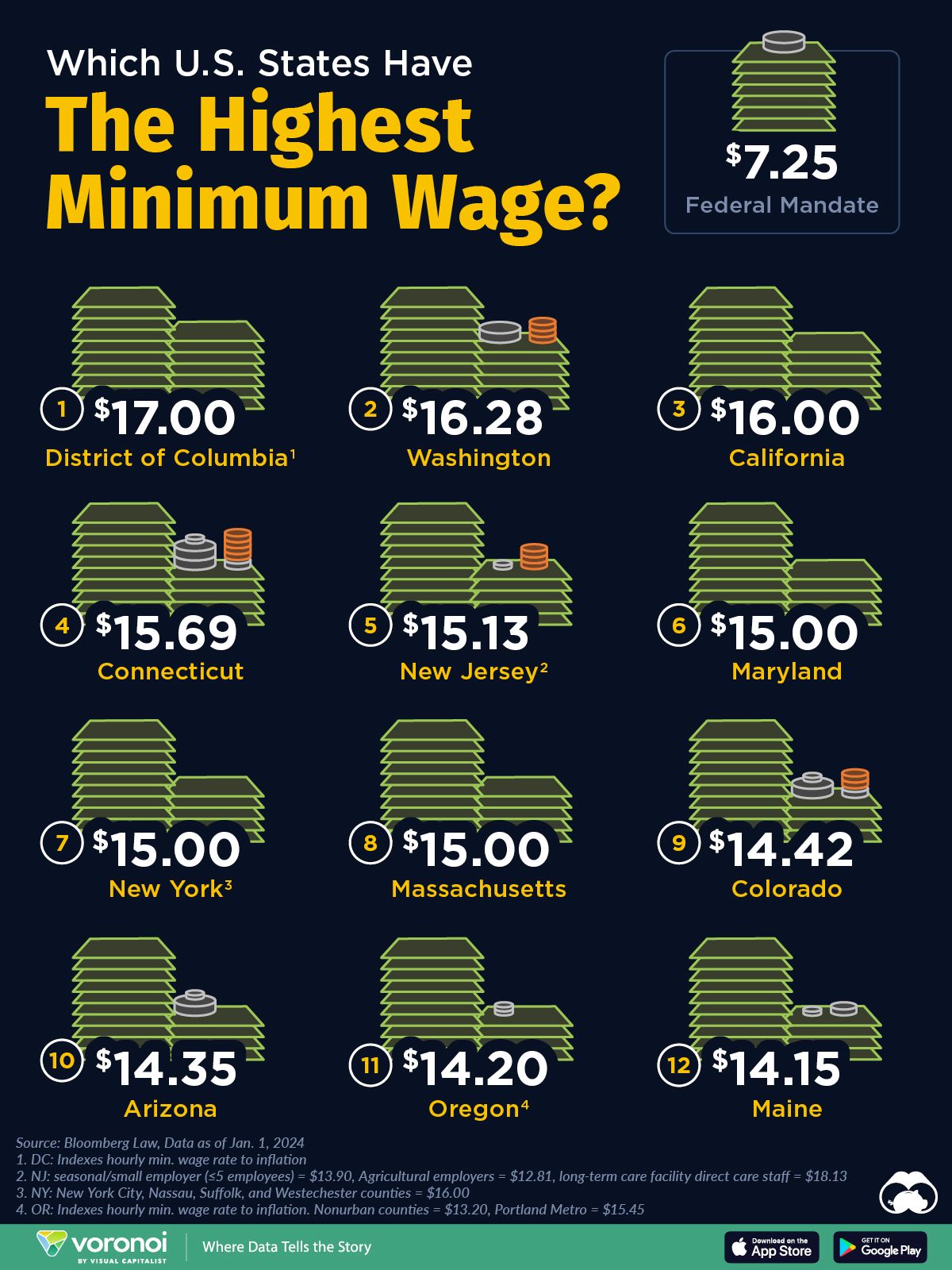

Visual of the Day

Was this email forwarded to you? Don't miss out on this valuable opportunity to elevate your knowledge and expertise in the world of NNN investment properties. Sign up for Hughes CRE Insider today and join our community of commercial real estate professionals committed to success.

To subscribe to Hughes CRE Insider and stay up-to-date with the latest NNN investment property insights, click here (Subscribe).

Thank you for choosing Hughes CRE Insider as your trusted source for Triple Net investment property news and analysis.

Best regards,

Hughes CRE Insider Team