🏢 Your Source for Triple Net (NNN) Investment Property Insights

Hello NNN Enthusiasts!

Welcome to Hughes CRE Insider, your FREE go-to source for the latest insights, trends, and updates in the world of Triple Net (NNN) commercial investment properties. Whether you're a seasoned commercial real estate broker or an owner/investor looking to dive into the world of NNN properties, our newsletter is tailored to provide you with valuable knowledge and resources to enhance your expertise and success in this lucrative sector.

Featured Article

Tenant Creditworthiness: Importance of Strong Tenant Credit Ratings in NNN Investments

In the realm of real estate investments, particularly in the context of triple net lease (NNN) properties, understanding tenant creditworthiness is paramount. This often-overlooked aspect can significantly impact the success and stability of your investment portfolio. In this article, we delve into the importance of strong tenant credit ratings in NNN investments.

What are NNN Investments?

Before delving into the significance of tenant creditworthiness, let's briefly touch upon what NNN investments entail. NNN investments involve properties where tenants are responsible for not only rent but also for covering property taxes, insurance, and maintenance costs. These investments typically offer stable, predictable income streams for investors.

The Significance of Tenant Creditworthiness

When considering NNN investments, one of the primary factors to evaluate is the creditworthiness of the tenant. Tenant creditworthiness refers to the tenant's ability to fulfill their lease obligations, particularly paying rent, over the lease term. Here's why it matters:

1. Stability and Predictability: Strong tenant credit ratings provide a level of stability and predictability to your investment. Tenants with excellent credit are more likely to meet their financial obligations consistently, ensuring a steady income stream for you as the landlord.

2. Reduced Risk of Default: A tenant with a solid credit rating is less likely to default on their lease agreement. This reduces the risk of unexpected vacancies, which can be detrimental to your investment returns.

3. Enhanced Property Value: Properties leased to financially stable tenants tend to have higher market value. Investors often pay a premium for properties with creditworthy tenants due to the reduced risk and steady cash flow they offer.

4. Financing Opportunities: Lenders are more inclined to offer favorable financing terms for properties leased to tenants with strong credit ratings. This can translate to lower interest rates, higher loan amounts, and better overall financing terms, ultimately maximizing your investment potential.

5. Long-Term Stability: NNN investments are often long-term commitments. Choosing tenants with robust creditworthiness increases the likelihood of maintaining stable rental income over the lease term, ensuring the longevity and profitability of your investment.

Evaluating Tenant Creditworthiness

So, how do you assess tenant creditworthiness? Here are some key steps:

1. Review Credit Agencies: A tenant with a robust credit profile, evidenced by high credit ratings from agencies like Moody's or S&P, suggests lower default risk.

2. Analyze Financial Statements: Review the tenant's financial statements to gauge their liquidity, debt levels, and profitability. A healthy balance sheet is indicative of strong creditworthiness.

3. Consider Industry Reputation: Evaluate the tenant's reputation within their industry. Companies with strong brand recognition and stable market positions are more likely to maintain strong credit ratings.

4. Seek Professional Advice: Consider consulting with financial advisors, real estate professionals, or credit analysts who can provide insights into evaluating tenant creditworthiness effectively.

Conclusion

In the realm of NNN investments, tenant creditworthiness is a critical factor that shouldn't be overlooked. Investing in properties leased to tenants with strong credit ratings offers stability, reduced risk, and enhanced long-term returns. By thoroughly assessing tenant creditworthiness and choosing financially sound tenants, you can bolster the success and resilience of your investment portfolio.

As always, thorough due diligence and careful consideration are key to making informed investment decisions.

NNN Property Spotlight

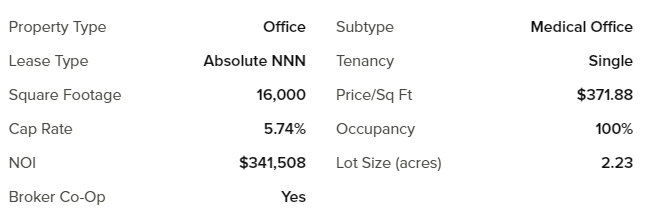

Presenting a prime commercial property at 1210 New Garden Road, Greensboro NC, this immaculate medical building offers an outstanding opportunity, particularly suitable for 1031 exchanges. Housing a single, stable medical tenant with a substantial practice across multiple locations, this facility was purpose-built for them in 2014, with an expansion completed in 2017. Potential for significant rental increases and escalations upon lease renewal, making it an attractive investment prospect. The current triple net lease generates $341,508 annually, with escalations of 1.5% per year. Furthermore, the lease terms offer room for lease renewal negotiation, presenting a favorable chance to enhance both rent and annual escalations, capitalizing on CPI growth. The property boasts a recent upgrade, with all rooftop HVAC units replaced in 2019 due to hail damage. With a solid, long-term tenant, a modern brick building, and a strategic location, priced at $5,950,000, this offering represents an excellent 1031 replacement opportunity. Contact for OM & Rent Schedule

Industry News Roundup

Stay up to date with the latest news and developments in the triple net (NNN) industry with our curated roundup of headlines from around the web.

-Dollar Tree to close 600 Family Dollar’s in 2024 (Read More)

-Pilot Travel Centers to add 35 locations, remodel 75 in 2024 (Read More)

-BJ’s to open 12 new stores in 2024; will enter new state next year (Read More)

-Net Lease Could Get Relief Under Tax Bill (Read More)

-Aldi to add 800 stores to network by 2028 (Read More)

NNN Fast 5

Increasing Demand: Triple net (NNN) properties continue to attract investors due to their stable income streams and low management requirements.

Retail Resilience: Despite shifts in consumer behavior, NNN properties anchored by essential retailers like pharmacies and dollar stores remain resilient, offering investors reliable returns.

ESG Considerations: Environmental, Social, and Governance (ESG) factors are becoming increasingly important in NNN property investments, with investors seeking sustainable and socially responsible assets.

Remote Work Impact: The rise of remote work has led to increased scrutiny of office and commercial NNN properties, with investors assessing potential shifts in demand and lease structures.

Technology Integration: Innovations in proptech are reshaping NNN property management, with trends such as smart building technologies and data analytics enhancing operational efficiency and tenant satisfaction.

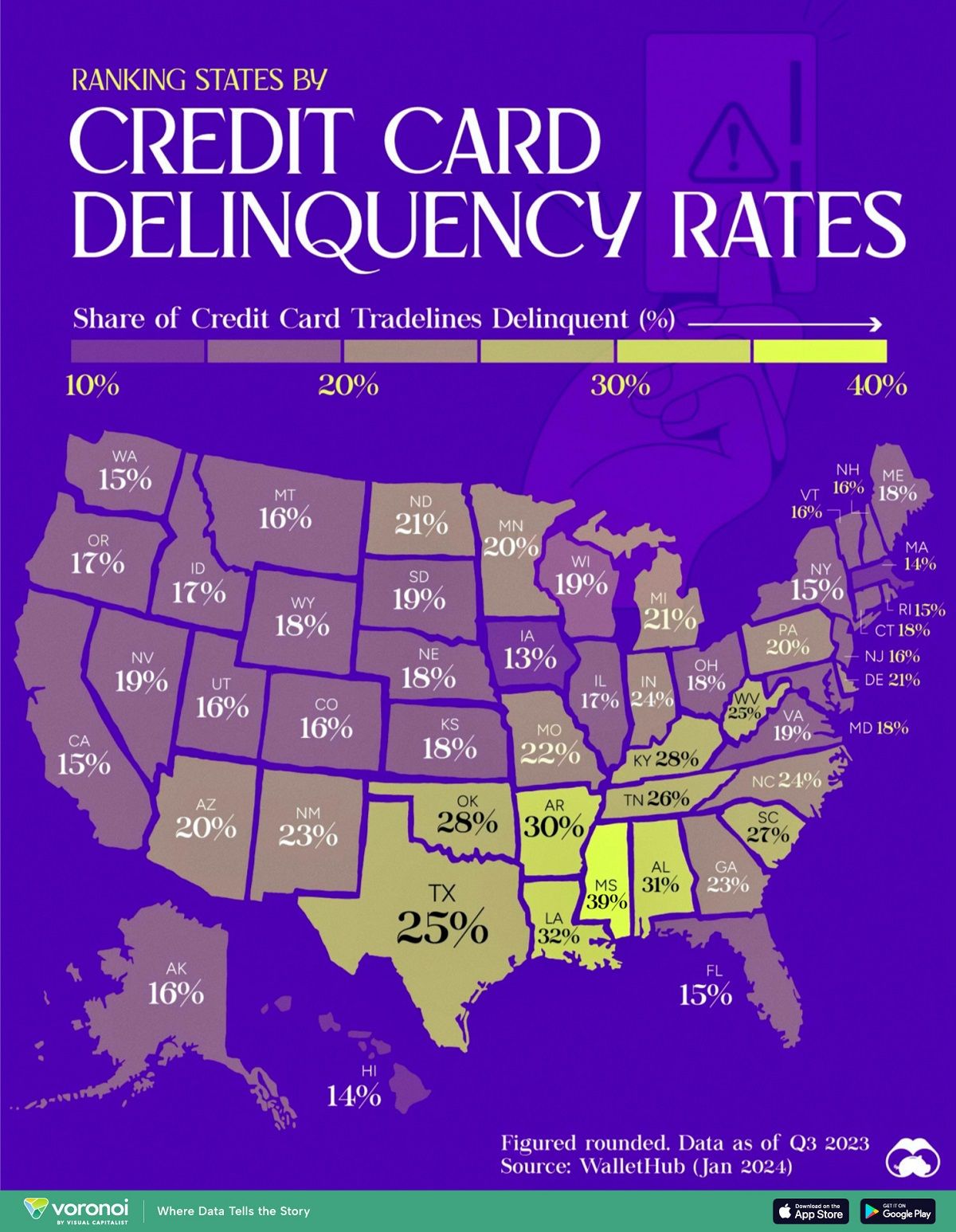

Visual of the Day

Was this email forwarded to you? Don't miss out on this valuable opportunity to elevate your knowledge and expertise in the world of NNN investment properties. Sign up for Hughes CRE Insider today and join our community of commercial real estate professionals committed to success.

To subscribe to Hughes CRE Insider and stay up-to-date with the latest NNN investment property insights, click here (Subscribe).

Thank you for choosing Hughes CRE Insider as your trusted source for Triple Net investment property news and analysis.

Best regards,

Hughes CRE Insider Team