🏢 Your Source for Commercial Real Estate, Business Brokerage and M&A Insights

At Hughes Commercial, we deliver actionable insights and strategies at the intersection of commercial real estate (CRE), business brokerage, and mergers & acquisitions (M&A). Each edition unpacks market trends, investment strategies, and deal-making opportunities to help you navigate CRE assets, business transactions, and portfolio growth.

Whether you're exploring income-producing properties or negotiating business deals, our goal is to equip you with the tools to seize opportunities and build lasting success.

Learn AI in 5 minutes a day

This is the easiest way for a busy person wanting to learn AI in as little time as possible:

Sign up for The Rundown AI newsletter

They send you 5-minute email updates on the latest AI news and how to use it

You learn how to become 2x more productive by leveraging AI

Featured Article

Seller Financing and 1031 Exchanges: Can You Still Defer Taxes?

In today’s market, seller financing is making a comeback. Whether it's to help a deal pencil out or to get across the finish line in a high-interest environment, more sellers are carrying paper. One of the most common questions we hear when this structure comes into play is:

“Can I still do a 1031 exchange if I offer seller financing?”

The short answer: Yes, you can. But the structure matters—a lot—and it's important to understand your options and the implications for tax deferral. Let’s walk through an example:

Scenario:

Sale Price: $1,000,000

Existing Mortgage: $0

Cash at Closing: $500,000

Seller Financing Note: $500,000

Reinvestment Goal (to fully defer taxes): $1,000,000

You’ve got three main paths forward:

Option 1: 1031 Exchange on Cash Only

You exchange the $500,000 in cash and pay capital gains taxes on the remaining $500,000 (the seller note), which is treated as boot—a taxable portion of the sale.

This may be acceptable in some cases, but you’ll want to model the tax hit carefully with your CPA before proceeding.

Option 2: Exchange the Cash and the Seller Note

In this scenario, you attempt to assign the note as part of the consideration in your next purchase. In theory, this gets you to your $1M reinvestment goal and avoids boot.

However, this is the trickiest option:

The seller of the replacement property must agree to accept the note as partial payment.

Your Qualified Intermediary must be on board.

You’ll need solid legal guidance to structure it correctly.

This can work, but it’s complicated and not for the faint of heart.

Option 3: Exchange the Cash, Replace the Note with New Cash

This is usually the cleanest and most straightforward solution. Here’s how it works:

Exchange the $500,000 in cash.

Bring in an additional $500,000 from savings or a loan.

Buy a $1,000,000 replacement property.

You’ve met your reinvestment requirement and fully deferred capital gains taxes—no boot, no headaches.

Bottom Line:

Seller financing doesn't kill your ability to do a 1031 exchange—but it does make it more complex. If you're considering this strategy, get your CPA, legal counsel, and exchange accommodator involved early so you don’t trip over the details.

Have questions? We're here to walk you through it.

🚀 Fast-Track Your Property Sale with Our 100-Day List-to-Close Solution

Looking to sell your commercial property quickly and efficiently? Hughes Commercial, in partnership with Ten-X, offers a streamlined process to take your property from listed to closed in just 100 days. Here’s how we make it happen:

🔹 Efficient, Low-Risk Selling with Ten-X 🔹

✅ Streamlined Process

45-day targeted marketing campaign

48-hour online bidding event

Non-contingent closing within ~30 days for fast, reliable execution

✅ No Upfront Costs

Sellers pay nothing upfront—Ten-X is compensated by the buyer upon a successful sale

✅ Seller Protection

Set a reserve price and sell only if that price is met, minimizing downside risk

✅ High Certainty of Close

Buyers are prequalified and must provide proof of funds

10% non-refundable earnest money deposit (EMD) required from day one

✅ Comprehensive Due Diligence

Phase I and Property Condition Assessment reports (~$2,200 each) provided upfront

Sellers reimburse Ten-X only if the property sells—otherwise, the reports are free

✅ Global Buyer Reach & Premium Marketing

Exposure to a vast network of qualified buyers through CoStar, LoopNet, and Ten-X

Complimentary Diamond Ad included ($30,000–$50,000 value) for maximum visibility

👉 Maximize your property's value with a proven platform—contact us today to get started!

Grow smarter: Reallocate ad spend, boost ROAS with affiliates

Ad spend keeps climbing. ROAS? Not so much.

The smartest Amazon sellers aren’t spending more—they’re spending smarter.

The Affiliate Shift Calculator models what could happen if you reallocated a portion of your ad budget into affiliate marketing.

Built for sellers doing $5M+ on Amazon.

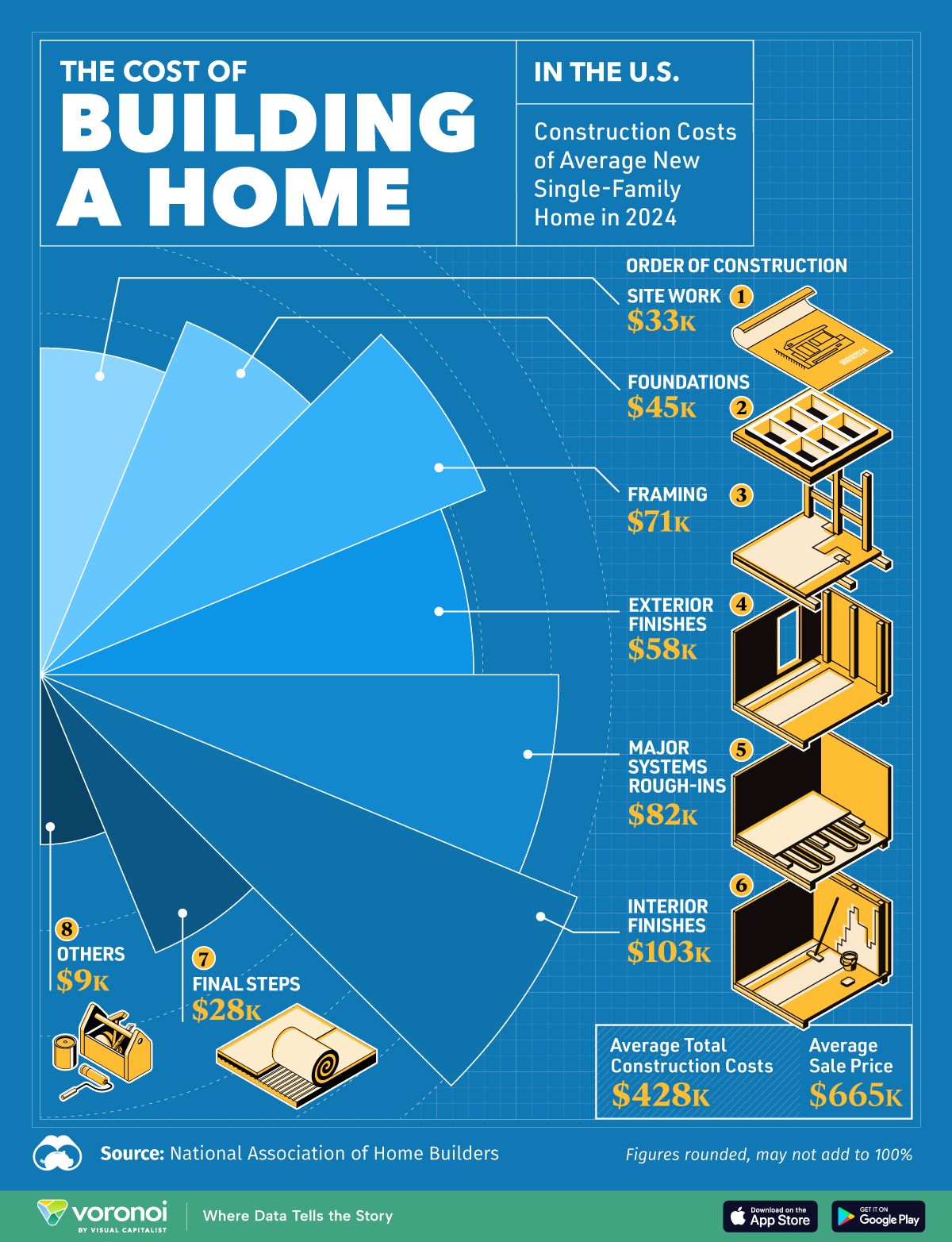

Visual of the Day

Was this email forwarded to you? Don't miss out on this valuable opportunity to elevate your knowledge and expertise in the world of commercial real estate, business brokerage and M&A activity. Sign up for Hughes Commercial Insider today and join our community of commercial real estate professionals committed to success.

To subscribe to Hughes Commercial Insider and stay up-to-date with the latest insights, click here (Subscribe).

Best regards,

Hughes Commercial