🏢 Your Source for Triple Net (NNN) Investment Property Insights

Hello NNN Enthusiasts!

Welcome to Hughes CRE Insider, your FREE go-to source for the latest insights, trends, and updates in the world of Triple Net (NNN) commercial investment properties. Whether you're a seasoned commercial real estate broker or an owner/investor looking to dive into the world of NNN properties, our newsletter is tailored to provide you with valuable knowledge and resources to enhance your expertise and success in this lucrative sector.

🙏If you enjoy reading Hughes CRE Insider | Net Lease and want to show your support, please check out our advertising partners by taking a second to simply click on the link below (no purchase or sign-up necessary). This will allow us to keep sending you FREE newsletter content straight to your inbox!

Learn AI in 5 minutes a day.

The Rundown is the world’s largest AI newsletter, read by over 600,000 professionals from companies like Apple, OpenAI, NASA, Tesla, and more.

Their expert research team spends all day learning what’s new in AI and gives you ‘the rundown’ of the most important developments in one free email every morning.

The result? Readers not only keep up with the insane pace of AI but also learn why it actually matters.

Featured Article

NNN vs. Gross Leases: Comparing NNN Leases with Gross Leases and Their Benefits

In the realm of commercial real estate, lease agreements come in various forms, with each offering unique advantages and disadvantages for both landlords and tenants. Two of the most common types are NNN (Triple Net) leases and Gross leases. Understanding the differences between these leases can help property owners and business tenants make more informed decisions.

What is a NNN Lease?

A NNN lease, or Triple Net lease, is a lease agreement where the tenant is responsible for paying all three of the 'net' expenses: property taxes, insurance, and maintenance costs, in addition to the base rent. This type of lease is commonly used in commercial properties such as retail centers, office buildings, and industrial spaces.

Benefits of NNN Leases for Landlords:

1. Predictable Income: Since tenants cover variable expenses, landlords enjoy a steady and predictable stream of income.

2. Reduced Management Responsibilities: Landlords are relieved of the burden of managing property-related expenses, as tenants handle maintenance and repairs.

3. Attractive to Investors: The predictable income and reduced management responsibilities make NNN properties appealing to investors seeking low-risk investments.

Benefits of NNN Leases for Tenants:

1. Control over Property Expenses: Tenants can directly manage and potentially reduce operating costs, such as maintenance and repairs.

2. Long-Term Stability: NNN leases often involve longer terms, providing tenants with stability and the ability to build out their space as needed.

3. Tax Benefits: Some tenants can benefit from tax deductions on the property expenses they incur.

What is a Gross Lease?

A Gross lease, on the other hand, is a lease agreement where the landlord is responsible for most or all of the property's operating expenses, including taxes, insurance, and maintenance. The tenant pays a fixed rent, which covers these costs.

Benefits of Gross Leases for Landlords:

1. Simplicity: Gross leases are straightforward, with one fixed rent payment covering all expenses, simplifying rent collection.

2. Control over Property: Landlords maintain control over property maintenance and management, ensuring the property is kept in good condition.

3. Attracts Tenants: The simplicity and predictability of a gross lease can attract more tenants, particularly those who prefer not to deal with fluctuating expenses.

Benefits of Gross Leases for Tenants:

1. Predictable Expenses: Tenants benefit from predictable monthly expenses without the worry of unexpected maintenance costs or fluctuating property taxes.

2. Simplicity and Convenience: With the landlord handling maintenance and other expenses, tenants can focus more on their business operations.

3. Budgeting Ease: The fixed rent allows for easier budgeting and financial planning, especially for small businesses or startups.

Choosing Between NNN and Gross Leases

When deciding between a NNN lease and a Gross lease, it's essential to consider your priorities and business needs.

- For Landlords: If you seek reduced management responsibilities and stable, predictable income, a NNN lease might be more appealing. However, if you prefer maintaining control over the property and ensuring its upkeep, a Gross lease could be more suitable.

- For Tenants: If you value control over operating expenses and long-term stability, a NNN lease might be the way to go. On the other hand, if you prefer predictable, all-inclusive rent payments and less responsibility for property maintenance, a Gross lease might be better.

Conclusion

Both NNN and Gross leases have their unique benefits, catering to different needs of landlords and tenants. By understanding the nuances of each type, you can make an informed decision that aligns with your financial goals and management preferences. Whether you are a property owner looking for a hassle-free income stream or a tenant seeking predictable expenses, knowing the differences between these lease types is crucial for a successful leasing experience.

NNN Properties Nationwide

SEARCH INVENTORY OF TRIPLE NET INVESTMENT PROPERTIES

Industry News Roundup

Stay up to date with the latest news and developments in the triple net (NNN) industry with our curated roundup of headlines from around the web.

-Single-Tenant Net Lease Deals Soared 26% in Q1 (Read More)

-Experts Weigh In on Latest Net Lease Trends (Read More)

-Retailers Look for Success in Secondary and Tertiary Markets (Read More)

-Net Lease Could Get Relief Under Tax Bill (Read More)

-Nation's largest restaurant chains increase units by 2% in 2023 (Read More)

NNN Tenant Profile

Tenant Description

Sonic is the largest chain of drive-in restaurants in the U.S.

Sonic properties are attractive net lease tenants due to their low price points, triple net leases, and substantial rental increases. Typically operating in 1,500 square foot buildings, Sonic's small footprint keeps property prices lower than most other net lease properties, although it can make re-tenanting a challenge. Sonic usually signs triple net leases, including both fee simple and ground leases, which free owners from landlord responsibilities. These leases often include rental increases during the primary term, although the specific terms can vary by location.

Founded in Shawnee, OK, Sonic revolutionized the ordering process by placing speakers curbside, allowing customers to place orders without leaving their cars. Sonic went public in 1991 under the ticker SONC and now boasts 3,593 locations across 45 states. Its highly diverse menu includes breakfast burritos, cheeseburgers, specialty drinks, and ice cream.

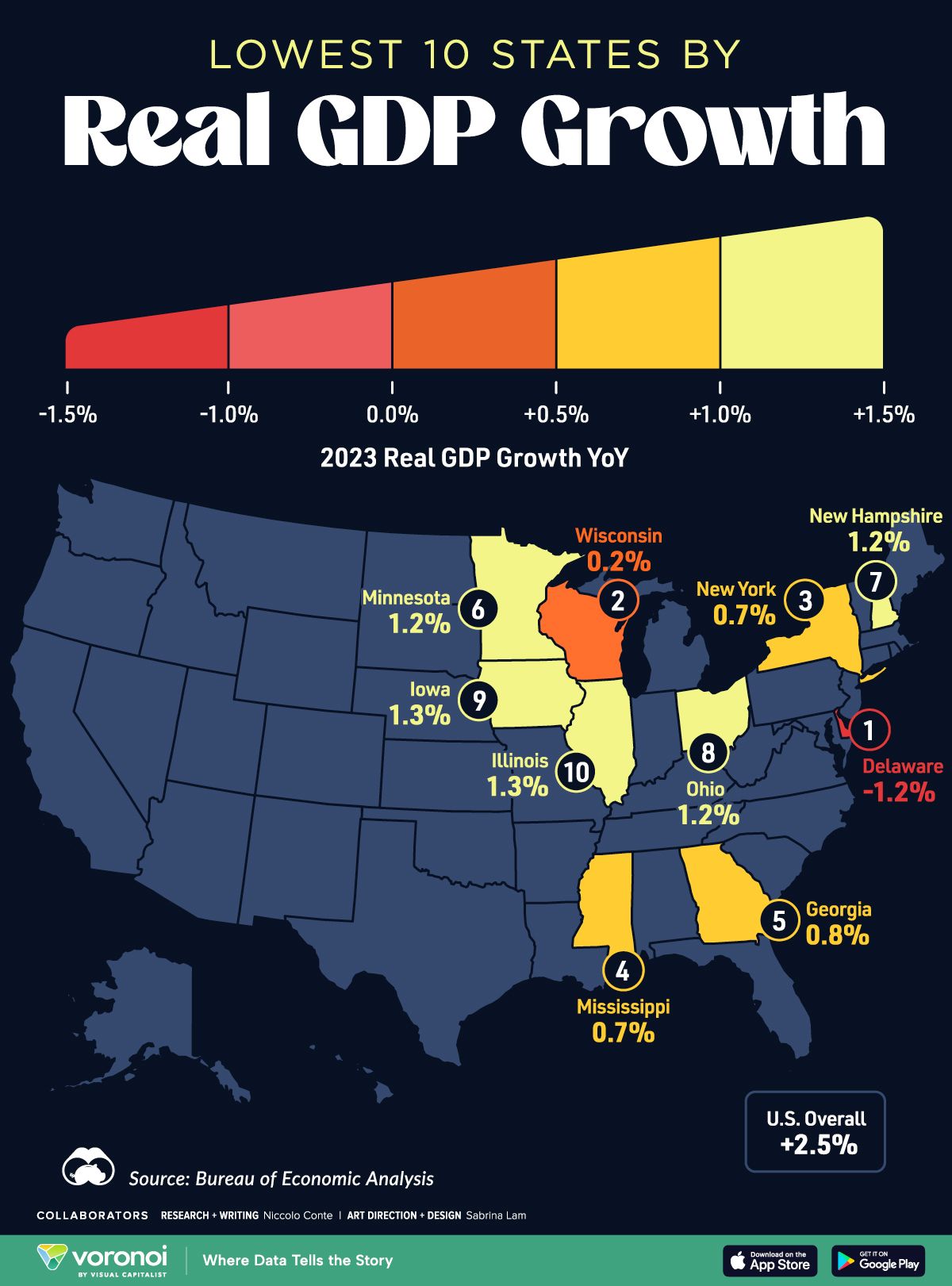

Visual of the Day

Was this email forwarded to you? Don't miss out on this valuable opportunity to elevate your knowledge and expertise in the world of NNN investment properties. Sign up for Hughes CRE Insider today and join our community of commercial real estate professionals committed to success.

To subscribe to Hughes CRE Insider and stay up-to-date with the latest NNN investment property insights, click here (Subscribe).

Thank you for choosing Hughes CRE Insider as your trusted source for Triple Net investment property news and analysis.

Best regards,

Hughes CRE Insider Team