🏢 Your Source for Commercial Real Estate, Business Brokerage and M&A Insights

At Hughes Commercial, we deliver actionable insights and strategies at the intersection of commercial real estate (CRE), business brokerage, and mergers & acquisitions (M&A). Each edition unpacks market trends, investment strategies, and deal-making opportunities to help you navigate CRE assets, business transactions, and portfolio growth.

Whether you're exploring income-producing properties or negotiating business deals, our goal is to equip you with the tools to seize opportunities and build lasting success.

Happy Investing!

🙏If you enjoy reading Hughes CRE Insider and want to show your support, please check out our advertising partners by taking a second to simply click on the link below (no purchase or sign-up necessary). This will allow us to keep sending you FREE newsletter content straight to your inbox!

The Real Estate Professional’s Secret Weapon - Land id™

Discover extensive nationwide private parcel data, create & showcase powerful, shareable, interactive maps of any property: Fast, Easy and Mobile, with Land id™.

With the brand new streamlined Property Info Cards, Land id™ brings industry leading data and contextual layers to the forefront in a single tap or swipe.

Featured Article

Mastering Business Valuations: What Every Buyer and Seller Needs to Know

Introduction: In the world of business brokerage and M&A, valuation is the cornerstone of every successful transaction. Whether you're preparing to sell your business, exploring an acquisition, or advising clients, understanding the factors that drive valuations is critical. In this edition, we’ll delve into the core valuation techniques to help you navigate business deals with confidence.

Key Factors Driving Business Valuations

Understanding the key drivers of business valuations is essential for both buyers and sellers. These factors provide a comprehensive view of a business’s worth, going beyond simple financial metrics to capture the full picture of its potential. Let’s explore the six critical elements:

Earnings and Cash Flow

Earnings before interest, taxes, depreciation, and amortization (EBITDA) is a fundamental metric. It reflects the profitability and operational efficiency of a business, providing a clear picture of its financial health.

Growth Potential

Future growth prospects can significantly impact valuation. Businesses with scalable models, innovative products, or services, and expansion opportunities tend to command higher valuations.

Industry Trends

Staying aligned with industry trends is crucial. Businesses operating in sectors with positive growth trends or technological advancements often attract higher valuations due to perceived future potential.

Customer Base and Contracts

A diverse and loyal customer base adds stability and reduces risk. Long-term contracts and recurring revenue streams further enhance a business’s value by ensuring predictable future income.

Operational Efficiency

Efficient operations lead to cost savings and higher profit margins. Streamlining processes, reducing waste, and leveraging technology can make a business more attractive to buyers.

Tangible and Intangible Assets

Tangible assets like real estate, equipment, and inventory contribute to valuation, but intangible assets—such as brand reputation, intellectual property, and customer relationships—often play a more significant role in driving value.

Key Takeaways:

Focus on EBITDA: While EBITDA remains a primary valuation metric, it's crucial to consider other factors like intangible assets and industry trends.

Industry-Specific Influences: The buyer's perception of risk and growth potential in your industry significantly impacts multiples.

Boosting Valuation: Address inefficiencies, diversify revenue streams, and align your business with industry benchmarks to enhance valuation.

Looking for Expert Valuation Guidance? At Hughes Commercial, we specialize in navigating the complexities of business valuations. Whether you're buying, selling, or advising, our team is here to provide tailored strategies that maximize value.

📩 Contact us today to discuss your business goals.

Happy Deal-Making!

Hughes Commercial

Fast-Track Your Property Sale with Our 100-Day List-to-Close Solution |

Are you looking to sell your commercial property quickly and efficiently? Through our exclusive partnership with Ten-X, Hughes Commercial offers a streamlined solution to get your property from listed to closed in just 100 days. Here's how we make it happen: |

Efficient Process: A streamlined 45-day marketing period, followed by a 48-hour online bidding event and a non-contingent close within ~30 days, ensuring certainty in execution.

No Upfront Cost: Sellers incur no upfront costs; Ten-X is paid by the buyer upon a successful sale.

Seller Protection: Sellers set a reserve price and are not obligated to sell unless this price is met, minimizing risk.

High Certainty of Close: Buyers are prequalified, must provide proof of funds, and commit with a 10% non-refundable EMD from day one.

Comprehensive Due Diligence: All due diligence, including Phase I and Property Condition Assessment reports (valued at ~$2,200 each), is provided upfront. Sellers reimburse Ten-X only if the property sells; otherwise, the reports are free.

Global Buyer Pool & Premium Marketing: Access to a vast buyer network with premium marketing through CoStar, LoopNet, and Ten-X. Each listing includes a complimentary Diamond Ad (valued at $30,000-$50,000).

Maximize your property's value and minimize the time on market with our proven 100-day solution. Ready to get started? Contact us today to learn more! |

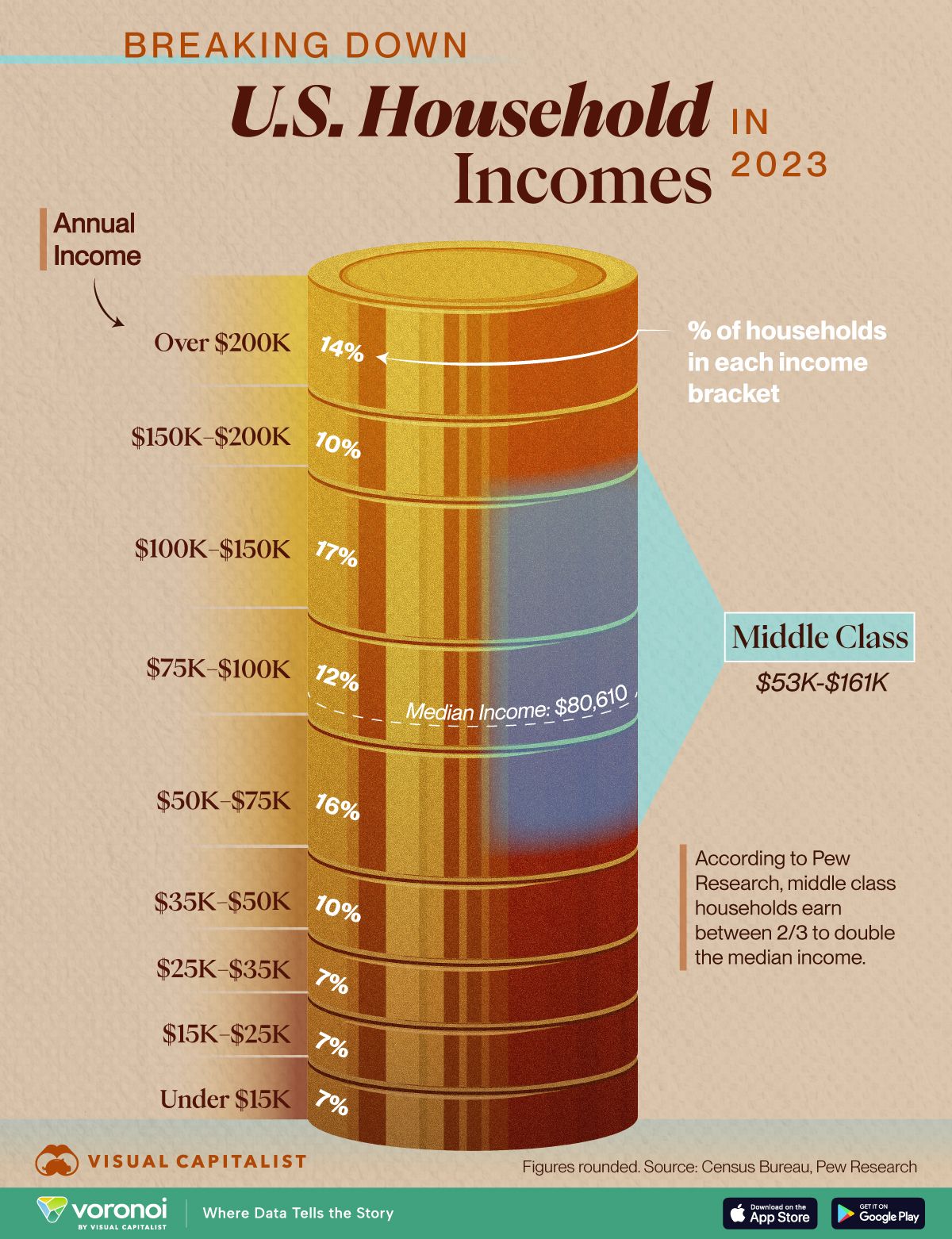

Visual of the Day

Was this email forwarded to you? Don't miss out on this valuable opportunity to elevate your knowledge and expertise in the world of commercial real estate, business brokerage and M&A activity. Sign up for Hughes CRE Insider today and join our community of commercial real estate professionals committed to success.

To subscribe to Hughes CRE Insider and stay up-to-date with the latest insights, click here (Subscribe).

Best regards,

Hughes CRE Insider Team