🏢 Your Source for Triple Net (NNN) Investment Property Insights

Hello NNN Enthusiasts!

Welcome to Hughes CRE Insider, your FREE go-to source for the latest insights, trends, and updates in the world of Triple Net (NNN) commercial investment properties. Whether you're a seasoned commercial real estate broker or an owner/investor looking to dive into the world of NNN properties, our newsletter is tailored to provide you with valuable knowledge and resources to enhance your expertise and success in this lucrative sector.

🙏If you enjoy reading Hughes CRE Insider | Net Lease and want to show your support, please check out our advertising partners by taking a second to simply click on the link below (no purchase or sign-up necessary). This will allow us to keep sending you FREE newsletter content straight to your inbox!

We put your money to work

Betterment’s financial experts and automated investing technology are working behind the scenes to make your money hustle while you do whatever you want.

Featured Article

Subject: Lease Termination Clauses: Evaluating the Implications for NNN Investments

In the dynamic world of real estate investment, especially within the realm of single tenant net lease (NNN) properties, understanding the intricacies of lease agreements is paramount. One crucial element that can significantly impact the value and stability of your investment is the lease termination clause. This article will delve into what lease termination clauses entail and their potential implications for your NNN investments.

What is a Lease Termination Clause?

A lease termination clause is a provision in a lease agreement that outlines the conditions under which the lease can be prematurely ended by either the tenant or the landlord. These clauses can be mutually agreed upon or favor one party more than the other, depending on the terms negotiated.

Types of Lease Termination Clauses

1. Early Termination Clauses: These allow the tenant to terminate the lease before the end of the agreed term, often in exchange for a penalty fee. This can be beneficial for tenants seeking flexibility but can pose risks for landlords if not carefully structured.

2. Break Clauses: Similar to early termination clauses, break clauses specify certain dates or conditions under which the tenant can exit the lease. These are typically negotiated at the outset of the lease agreement.

3. Landlord Termination Rights: In some cases, landlords may negotiate the right to terminate the lease under specific conditions, such as redevelopment plans or breach of lease terms by the tenant.

Evaluating Lease Termination Clauses

When assessing a lease termination clause, consider the following factors:

1. Financial Impact: Understand the financial penalties or compensations involved in early termination. This could include penalty fees, loss of rental income, or costs associated with finding a new tenant.

2. Tenant Creditworthiness: A high creditworthy tenant is less likely to exercise a termination clause, providing more stability. Conversely, a tenant with lower creditworthiness might be more inclined to exit early, especially during economic downturns.

3. Market Conditions: The local real estate market can influence the impact of a termination clause. In a strong market, re-leasing the property might be easier, mitigating the financial impact of an early termination.

4. Lease Structure and Terms: The specific terms of the lease, such as the length of notice required and the conditions under which termination is allowed, play a significant role in the risk assessment.

Implications for NNN Investors

For NNN investors, the presence of a lease termination clause can introduce an element of uncertainty. Here are some implications to consider:

- Risk Management: Investors need to evaluate the likelihood of a tenant exercising a termination clause and its potential impact on cash flow. Diversifying your portfolio can help mitigate the risk associated with any single tenant's early departure.

- Negotiation Leverage: Understanding the implications of termination clauses can provide leverage during lease negotiations. Investors can negotiate terms that balance tenant flexibility with financial protection.

- Long-Term Stability: Ensuring that the lease terms favor long-term stability can enhance the attractiveness of the investment to future buyers. A well-structured lease with limited early termination rights can be a selling point.

Conclusion

Lease termination clauses are a critical component of NNN lease agreements that require careful consideration. By thoroughly evaluating these clauses, investors can better manage risks and ensure the stability and profitability of their investments. Whether you’re negotiating a new lease or assessing an existing one, understanding the implications of termination clauses is essential for making informed investment decisions.

For more insights into NNN investments and expert advice, feel free to reach out to us.

NNN Properties Nationwide

SEARCH INVENTORY OF TRIPLE NET INVESTMENT PROPERTIES

Industry News Roundup

Stay up to date with the latest news and developments in the triple net (NNN) industry with our curated roundup of headlines from around the web.

-Why Car Washes, Gas Stations, and C-Stores Dominate Net Lease (Read More)

-Experts Weigh In on Latest Net Lease Trends (Read More)

-Friendly’s expands, eyes national growth (Read More)

-Tractor Supply opens 500th Garden Center; more to come (Read More)

-Jack in the Box plans 15 more Florida locations (Read More)

NNN Tenant Profile

Tenant Description

Del Taco: A Prime Net Lease Tenant

Overview:

Del Taco, a popular taco chain, primarily operates in the Southern and Western regions of the United States.

Attractive Investment Features:

Del Taco stands out as a desirable net lease tenant due to several key factors:

- Strong Rental Increases: Throughout the lease term, Del Taco properties experience significant rental escalations.

- Triple Net Leases (NNN): These leases relieve property owners of all maintenance responsibilities.

- Long Lease Terms: Ensuring long-term occupancy and stability for property owners.

Property Characteristics:

Del Taco locations typically consist of:

- Building Size: 2,000-2,500 square feet.

- Drive-Through Window: Enhancing convenience for customers.

- Parcel Size: Approximately 1 acre.

- High Visibility Locations: Situated in high-traffic areas.

Flexibility and Design:

The standardized design of Del Taco buildings allows for easy re-leasing to new tenants if necessary, making these properties versatile and adaptable investments.

Historical Background:

Founded in 1964 in Yermo, California, Del Taco (short for "Delicious Taco") began its journey into the restaurant industry. By the 1980s, the chain had expanded to around 350 restaurants, predominantly in California. Today, Del Taco is publicly traded on the NASDAQ under the ticker symbol TACO and operates 580 locations across 14 states, with a significant presence in the Pacific Southwest.

Unique Selling Proposition:

A distinctive feature of Del Taco is its dual menu offering, which includes both Mexican-inspired dishes and traditional American fare. This diverse menu appeals to a broader customer base, enhancing its market reach and customer loyalty.

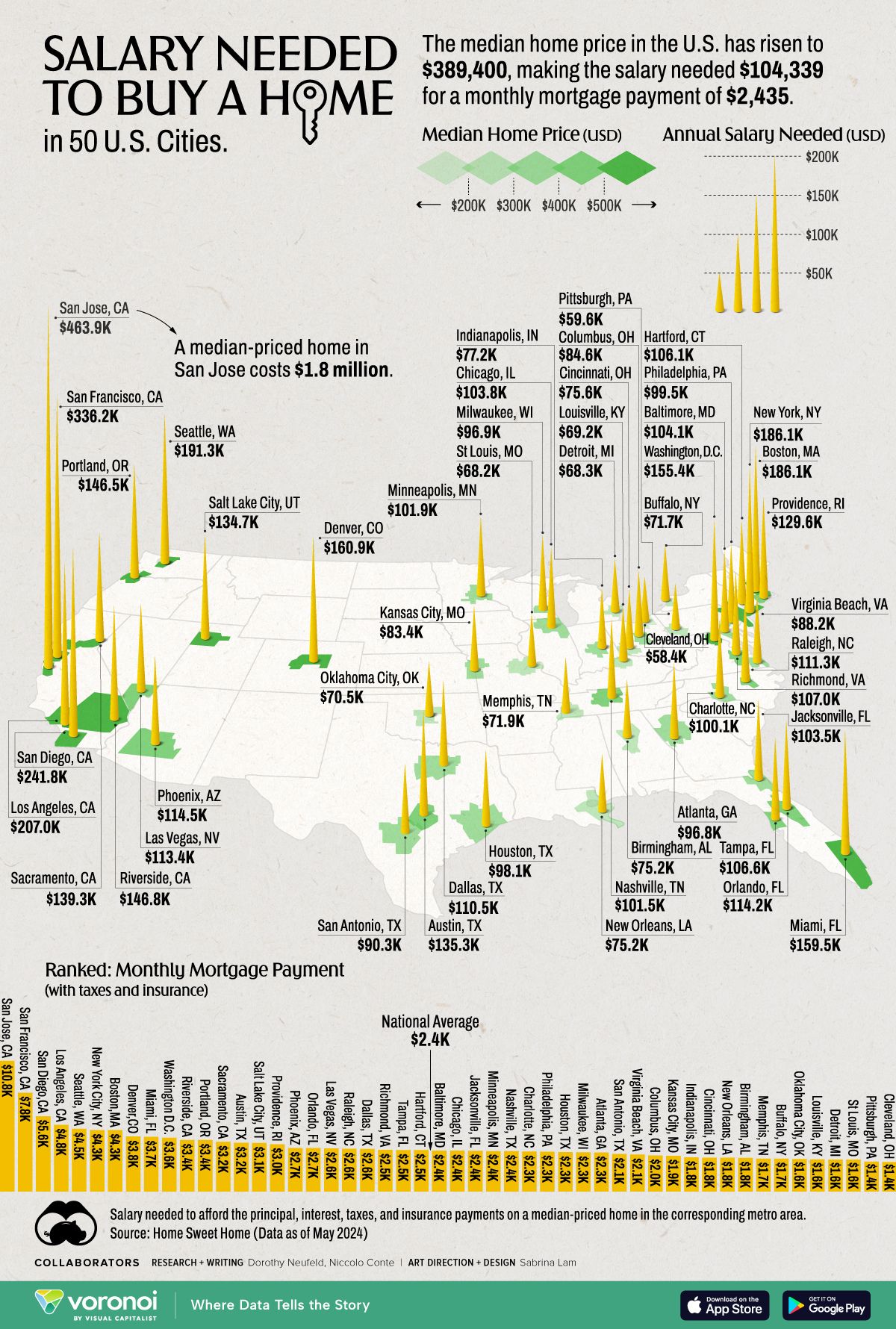

Visual of the Day

Was this email forwarded to you? Don't miss out on this valuable opportunity to elevate your knowledge and expertise in the world of NNN investment properties. Sign up for Hughes CRE Insider today and join our community of commercial real estate professionals committed to success.

To subscribe to Hughes CRE Insider and stay up-to-date with the latest NNN investment property insights, click here (Subscribe).

Thank you for choosing Hughes CRE Insider as your trusted source for Triple Net investment property news and analysis.

Best regards,

Hughes CRE Insider Team