🏢 Your Source for Commercial Real Estate, Business Brokerage and M&A Insights

At Hughes Commercial, we deliver actionable insights and strategies at the intersection of commercial real estate (CRE), business brokerage, and mergers & acquisitions (M&A). Each edition unpacks market trends, investment strategies, and deal-making opportunities to help you navigate CRE assets, business transactions, and portfolio growth.

Whether you're exploring income-producing properties or negotiating business deals, our goal is to equip you with the tools to seize opportunities and build lasting success.

Happy Investing!

🙏If you enjoy reading Hughes CRE Insider and want to show your support, please check out our advertising partners by taking a second to simply click on the link below (no purchase or sign-up necessary). This will allow us to keep sending you FREE newsletter content straight to your inbox!

This tech company grew 32,481%...

No, it's not Nvidia... It's Mode Mobile, 2023’s fastest-growing software company according to Deloitte.

Just as Uber turned vehicles into income-generating assets, Mode is turning smartphones into an easy passive income source, already helping 45M+ users earn $325M+ through simple, everyday use.

They’ve just been granted their stock ticker by the Nasdaq, and you can still invest in their pre-IPO offering at just $0.26/share.

*Mode Mobile recently received their ticker reservation with Nasdaq ($MODE), indicating an intent to IPO in the next 24 months. An intent to IPO is no guarantee that an actual IPO will occur.

*The Deloitte rankings are based on submitted applications and public company database research, with winners selected based on their fiscal-year revenue growth percentage over a three-year period.

*Please read the offering circular and related risks at invest.modemobile.com.

Featured Article

How Interest Rates Impact Cap Rates and Business Valuations: A Guide for Investors

Introduction

In today’s volatile economic environment, interest rates are a key factor influencing investment decisions in both commercial real estate (CRE) and business acquisitions. Understanding how rising rates affect cap rates and valuation multiples is critical for maximizing returns while mitigating risk. Whether you're evaluating a NNN lease property or acquiring a small business, this guide will help you navigate the complexities of interest rate impacts.

The Basics of Interest Rates and Cap Rates

What Are Interest Rates?

Interest rates, set by central banks like the Federal Reserve, represent the cost of borrowing money. When rates rise, borrowing becomes more expensive, affecting businesses, consumers, and investors alike.

What Are Cap Rates?

Cap rates, short for capitalization rates, measure the expected return on a CRE investment. The formula:

Cap Rate = Net Operating Income (NOI) ÷ Property Value

Cap rates are a critical metric for assessing property value. A lower cap rate indicates a higher valuation for the same NOI, while a higher cap rate suggests a lower valuation.

The Relationship Between Interest Rates and Cap Rates

Why Do Cap Rates Rise With Interest Rates?

As interest rates increase, the cost of borrowing capital rises, reducing the price investors are willing to pay for properties. This drives cap rates higher. For example:

A property generating $100,000 in NOI at a 5% cap rate is worth $2,000,000.

If the cap rate rises to 6%, the same NOI yields a property value of $1,666,667.

Investor Behavior in a High-Rate Environment

In high-rate markets, investors prioritize stability and income over speculative growth. NNN lease properties with long-term leases and creditworthy tenants become more appealing because they offer predictable cash flows.

How Interest Rates Impact Business Valuations

Valuation Multiples and Cost of Capital

Business valuations rely heavily on projected cash flows and the cost of capital. When interest rates rise:

Discount Rates: Higher rates increase the discount rate used in valuation models like discounted cash flow (DCF), reducing the present value of future cash flows.

Debt Financing: Leveraged buyouts (LBOs) become less attractive, as higher borrowing costs reduce potential returns for buyers.

Operational Impacts

Businesses with variable-rate debt may see increased interest expenses, squeezing margins and reducing profitability. This often leads to lower valuation multiples in industries heavily reliant on debt.

Strategies for Investors in a High-Rate Environment

For CRE Investors

Target Stable Assets: Focus on properties with long-term, fixed-rate NNN leases and creditworthy tenants.

Evaluate Refinancing: Lock in fixed rates on existing properties to hedge against future increases.

Negotiate Price: Use rising cap rates as leverage to secure favorable pricing.

For Business Buyers

Seek Low-Leverage Businesses: Look for targets with minimal reliance on debt to avoid the risk of margin compression.

Adjust Valuation Models: Reflect higher cost of capital in your pricing, ensuring the deal remains financially viable.

Consider Seller Financing: Negotiate terms that include seller-backed loans to offset rising borrowing costs.

Case Studies: Real-World Examples

CRE Case Study: Retail Property Cap Rate Shift

A retail property in a suburban market has an NOI of $120,000. Initially valued at a 5% cap rate, its price was $2,400,000.

After a 100-basis-point increase in interest rates, cap rates rise to 6%.

New valuation: $120,000 ÷ 6% = $2,000,000.

The investor negotiates a price reduction to account for the market shift.

M&A Case Study: Small Business Valuation Decline

A manufacturing business with $1M EBITDA was initially valued at a 5x multiple ($5M).

Rising rates increase the buyer’s cost of debt, prompting a lower multiple of 4.5x.

New valuation: $1M × 4.5 = $4.5M.

The seller agrees to an adjusted price with a partial earnout to bridge the gap.

Conclusion

Interest rates are a driving force in shaping investment landscapes for both CRE and business acquisitions. By understanding their impact, investors can adapt strategies to maintain profitability and secure better deals. Whether you're exploring NNN leases or pursuing a business acquisition, staying proactive is the key to success in a high-rate environment.

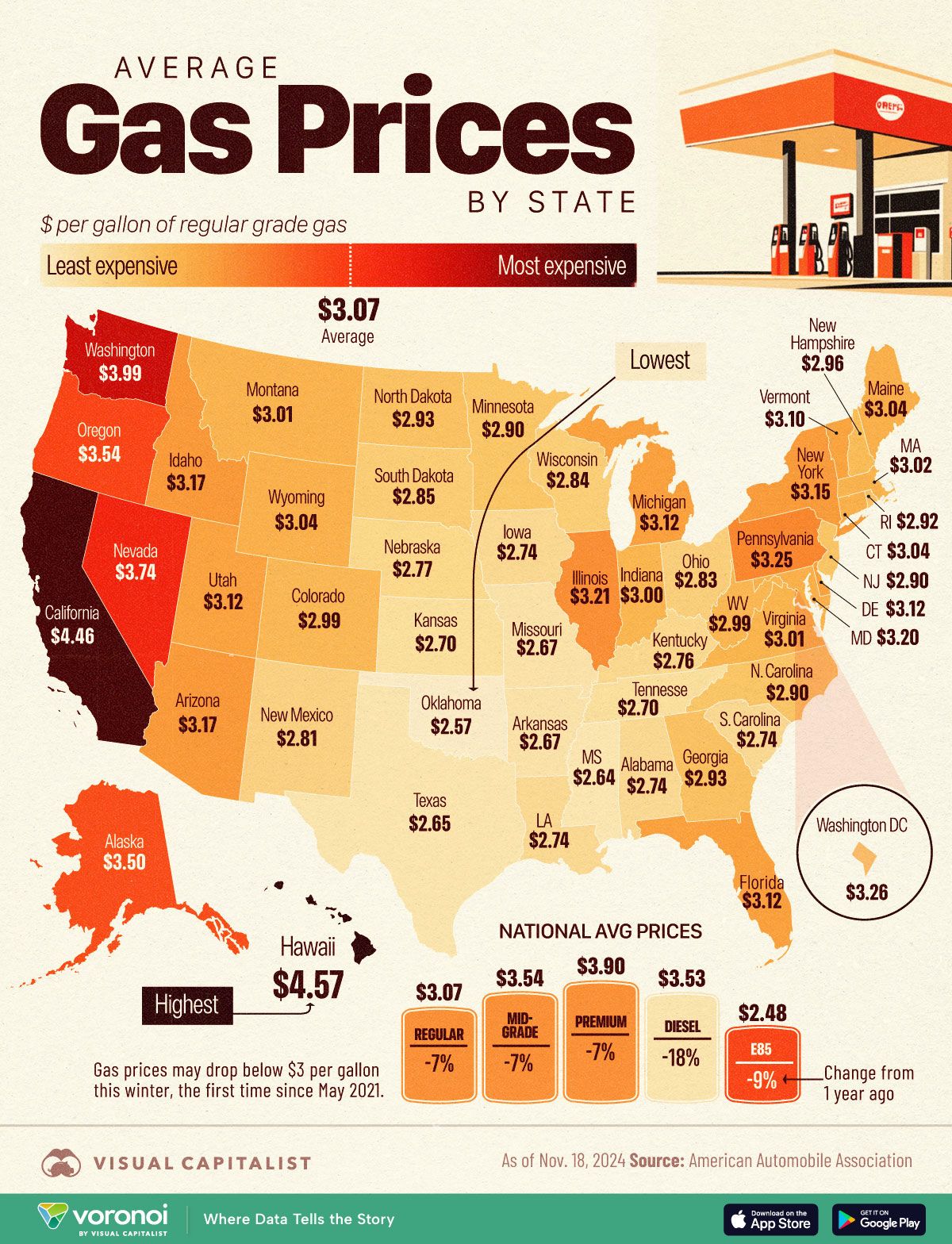

Visual of the Day

Was this email forwarded to you? Don't miss out on this valuable opportunity to elevate your knowledge and expertise in the world of commercial real estate, business brokerage and M&A activity. Sign up for Hughes CRE Insider today and join our community of commercial real estate professionals committed to success.

To subscribe to Hughes CRE Insider and stay up-to-date with the latest insights, click here (Subscribe).

Best regards,

Hughes CRE Insider Team