🏢 Your Source for Triple Net (NNN) Investment Property Insights

Hello NNN Enthusiasts!

Welcome to Hughes CRE Insider, your FREE go-to source for the latest insights, trends, and updates in the world of Triple Net (NNN) commercial investment properties. Whether you're a seasoned commercial real estate broker or an owner/investor looking to dive into the world of NNN properties, our newsletter is tailored to provide you with valuable knowledge and resources to enhance your expertise and success in this lucrative sector.

Featured Article

Exploring NNN Tenant Industry Trends: Assessing Stability and Growth Potential

NNN investments have long been favored by investors seeking steady income streams and minimal management responsibilities. These properties, leased to tenants who are responsible for property expenses such as taxes, insurance, and maintenance, offer a sense of security and predictability. However, the success of an NNN investment hinges greatly on the strength and resilience of the tenant's industry.

Let's examine some key industry trends shaping the NNN landscape:

1. Essential Retail: Amidst economic uncertainties and shifts in consumer behavior, essential retail sectors have emerged as stalwarts in the NNN realm. Industries such as pharmacies, convenience stores, and dollar stores have demonstrated remarkable stability, driven by consistent demand for essential goods and services. Investors are increasingly drawn to these recession-resistant assets, recognizing their ability to weather market fluctuations.

2. Healthcare: The healthcare sector continues to be a beacon of stability in the NNN space. Properties leased to medical offices, urgent care centers, and pharmacies remain highly sought-after due to demographic factors such as aging populations and increasing healthcare expenditures. With healthcare infrastructure becoming increasingly vital, these properties offer long-term income security and potential for growth.

3. QSR and Fast Casual Dining: While the restaurant industry faced unprecedented challenges during the pandemic, quick-service restaurants (QSRs) and fast-casual dining concepts have displayed resilience. Drive-thru capabilities, delivery services, and innovative technology adoption have enabled these establishments to adapt to changing consumer preferences. Investors keen on NNN properties leased to established QSR brands with strong fundamentals may find opportunities for steady returns.

4. E-Commerce Resilient Industries: As e-commerce continues to reshape the retail landscape, industries that support or complement online commerce are garnering attention from investors. Distribution centers, logistics facilities, and last-mile delivery hubs are in high demand, driven by the exponential growth of e-commerce sales. With the shift towards omnichannel retailing accelerating, NNN properties in these sectors offer potential for sustained growth.

5. Corporate Tenants: Large corporations with investment-grade credit ratings remain coveted NNN tenants, providing stability and reliability to investors. Industries such as banking, telecommunications, and drugstore chains often feature prominently in NNN portfolios due to their financial strength and long-term lease commitments.

In conclusion, evaluating the stability and growth potential of NNN tenant industries is imperative for informed investment decisions. While certain sectors exhibit resilience and promise, thorough due diligence is essential to mitigate risks and capitalize on opportunities. As trusted advisors in the commercial real estate arena, we remain committed to providing valuable insights and guidance to help you navigate the dynamic NNN market landscape.

NNN Property Spotlight

Car Wash Sale-Leaseback Opportunity | 7% Cap Rate | $942,000

Owner/Operator will sign a new 15-year lease w/ (two) 5 year lease renewals

10% rent increases every 5 years

Location has undergone extensive renovations recently

🚗 Prime Car Wash Sale-Leaseback Opportunity for Savvy Investors! 🚀

Welcome to 220 Faith Road, Salisbury, NC - the perfect destination for a lucrative car wash sale-leaseback opportunity, tailor-made for astute investors seeking to maximize returns through a 1031 exchange.

✨ Key Features:

1. Strategic Location: Nestled in the heart of Salisbury, this car wash boasts an enviable location on the bustling Faith Road. High traffic and visibility make it a prime spot for consistent business, ensuring a steady stream of customers.

2. Proven Revenue Stream: The car wash has a robust history of generating consistent revenue, making it a reliable investment for those looking to secure a steady income stream. The thriving local community and strategic positioning contribute to the business's success.

3. State-of-the-Art Facilities: Equipped with cutting-edge car wash technology, the facilities at 220 Faith Road are designed to deliver a top-notch customer experience. Modern equipment ensures efficiency, attracting a broad customer base and enhancing the overall value proposition.

4. Long-Term Lease in Place: A secure long-term lease is already in place, providing a stable and predictable income for the prospective investor. This is an ideal scenario for those engaged in a 1031 exchange, looking to seamlessly transition from one property to another without incurring capital gains taxes.

5. Investor-Friendly Terms: The sale-leaseback structure of this opportunity aligns perfectly with the needs of a 1031 exchange buyer. Enjoy the benefits of property ownership while simultaneously leveraging the tax advantages provided by the 1031 exchange program.

6. Growing Market: Salisbury, NC, is experiencing a period of economic growth, making it an attractive location for savvy investors. The car wash's success is poised to mirror the overall economic development of the area.

🔑 Why Perfect for a 1031 Exchange Buyer:

For investors looking to defer capital gains taxes through a 1031 exchange, this car wash opportunity ticks all the boxes. The seamless transition from relinquished to replacement property is facilitated by the existing lease, providing a hassle-free and tax-efficient investment avenue.

Invest with confidence at 220 Faith Road, Salisbury, NC, where prime location, reliable income, and investor-friendly terms converge to create an unparalleled car wash sale-leaseback opportunity.

📞 Contact us today to seize this golden chance for a profitable investment and capitalize on the benefits of a 1031 exchange! 🌟

Industry News Roundup

Stay up to date with the latest news and developments in the triple net (NNN) industry with our curated roundup of headlines from around the web.

-Single-Tenant Net Lease Sales Still Cramped (Read More)

-How Sale-Leasebacks Help PE Raise Capital in a Tight Market (Read More)

-BJ’s continues push into Southeast, Midwest with new locations — here’s where (Read More)

-Net Lease Could Get Relief Under Tax Bill (Read More)

-Academy Sports & Outdoors to open 160 to 180 stores over next five years (Read More)

NNN Tenant Profile

Tenant Description

Best Buy is an American multinational consumer electronics retailer that is headquartered in Richfield, Minnesota. The first Best Buy was started by Richard M. Schulze and James Wheeler in 1966, and it was named Sound of Music. Since it's inception, Best Buy has obviously grown tremendously and turned itself into a household name in American culture. Best Buy is one of the United States largest companies in terms of revenue, as it is listed in America's Fortune 500 largest companies. It is publicly listed on the New York Stock Exchange and trades under the ticker $BBY. Today, Best Buy has over 1,000 retail locations and employs around 125,000 people. It reported revenue of $42.88 billion in 2019 with operating income of $1.90 billion and a net income of $1.46 billion. Another unique trait about Best Buy is that it is the largest specialty retailer in the United States consumer electronics industry.

Best Buy net lease properties typically feature an average cap rate of 5.50%, with a 15-year lease term. The properties often span around 40,000 square feet on a lot size of 3.5-7.0 acres. The average sale price for such properties is about $10,645,000, with a Net Operating Income (NOI) of approximately $550,000 and a price per square foot of $225. These details underscore Best Buy's presence as a major player in the consumer electronics retail space with significant investment potential in the net lease market.

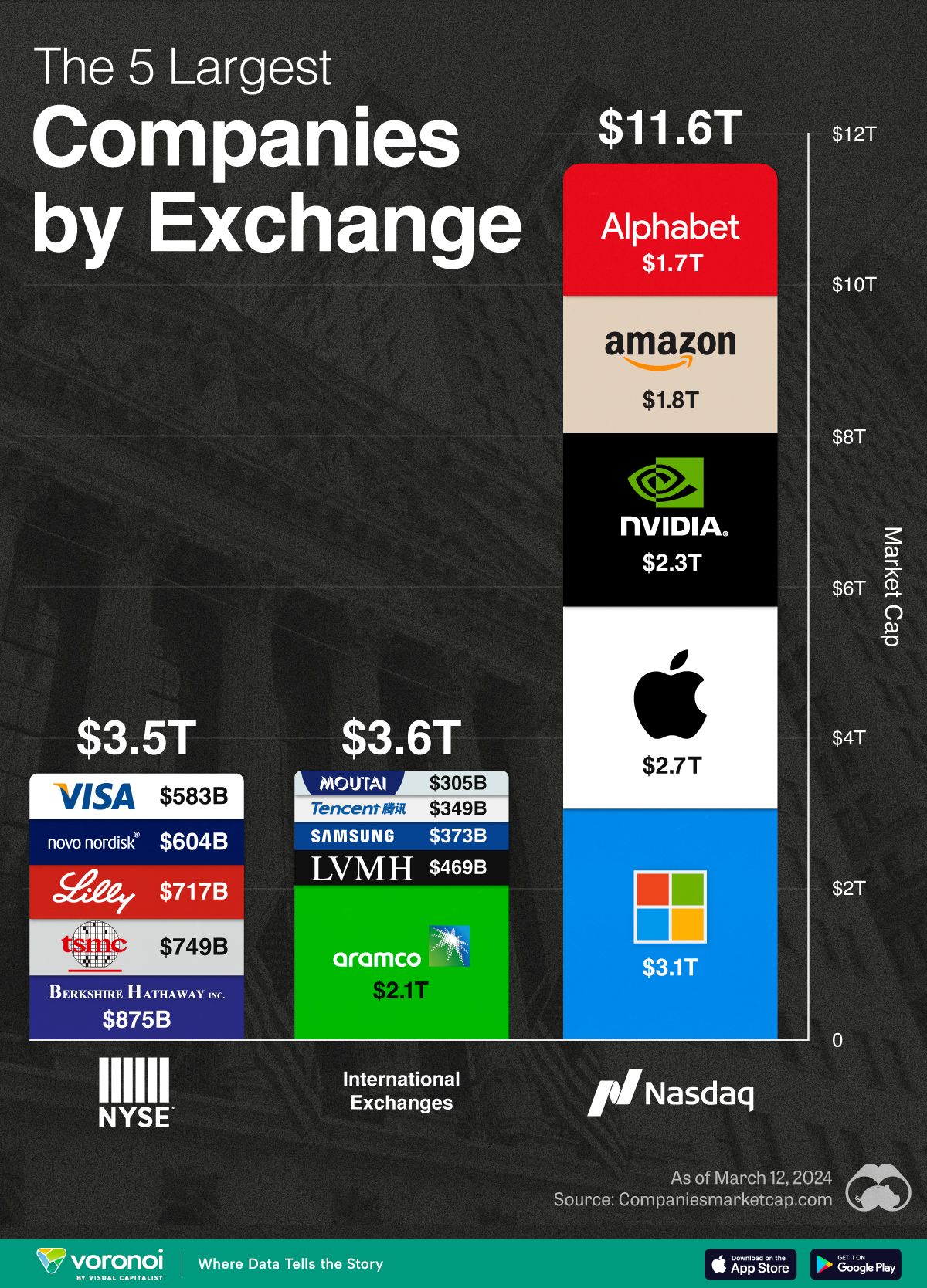

Visual of the Day

Was this email forwarded to you? Don't miss out on this valuable opportunity to elevate your knowledge and expertise in the world of NNN investment properties. Sign up for Hughes CRE Insider today and join our community of commercial real estate professionals committed to success.

To subscribe to Hughes CRE Insider and stay up-to-date with the latest NNN investment property insights, click here (Subscribe).

Thank you for choosing Hughes CRE Insider as your trusted source for Triple Net investment property news and analysis.

Best regards,

Hughes CRE Insider Team