🏢 Your Source for Triple Net (NNN) Investment Property Insights

Hello NNN Enthusiasts!

Welcome to Hughes CRE Insider, your FREE go-to source for the latest insights, trends, and updates in the world of Triple Net (NNN) commercial investment properties. Whether you're a seasoned commercial real estate broker or an owner/investor looking to dive into the world of NNN properties, our newsletter is tailored to provide you with valuable knowledge and resources to enhance your expertise and success in this lucrative sector.

Featured Article

Deciphering Cap Rates: Analyzing Current Trends and Their Influence on NNN Property Valuations

In the world of commercial real estate, cap rates are important for investors and brokers to understand. They help determine the value and potential return on investment of triple net lease properties. Cap rates compare a property's income to its market value. Changes in cap rates can affect how attractive and valuable these properties are, which can impact investment decisions and the market. In this article, we will explain cap rates, look at current trends, and discuss what this means for people involved in triple net lease properties.

What are Cap Rates?

Cap rates are a way to measure the expected return on an investment property. It is calculated by dividing the property's net operating income (NOI) by its market value and expressing it as a percentage. Lower cap rates mean lower risk and higher property values, while higher cap rates mean higher risk and potentially lower property values.

Understanding NNN Properties

NNN properties are popular among investors because they offer passive income. In these properties, tenants are responsible for paying property taxes, insurance, and maintenance costs, along with rent. This type of lease provides stable and predictable cash flows for property owners, making NNN investments appealing, especially during uncertain economic times.

Current Cap Rate Trends

Recently, the commercial real estate market has seen changes in cap rates. These changes are influenced by things like the economy, interest rates, investor feelings, and market demand. It's important to keep up with what's happening now in the market to make smart investment choices, even though looking at past trends can be helpful.

Impact on NNN Property Valuations

The relationship between cap rates and NNN property values can be tricky. When cap rates go down, property values usually go up. This can happen because more people want income-producing assets or because interest rates are low. On the other hand, if cap rates go up, property values may go down. This can affect how much money investors make and how easy it is to sell a property. If you own NNN properties, lower cap rates can mean higher property values and more chances to sell for a profit. But if cap rates go up, it may be harder to keep high property values, and you may need to manage your assets carefully to make the most money. Brokers who specialize in NNN properties can help you understand and deal with these changes in cap rates. They can give you a detailed market analysis, find good investment opportunities, and give advice on how to reach your goals and manage risks.

Conclusion

Cap rates are important for evaluating the value and risk of NNN properties. They affect investment strategies and the market. It's crucial for owners and investors to understand cap rate trends and what they mean. This helps them make the most of their investments and reduce risks in commercial real estate. By staying informed, getting expert advice, and doing thorough research, stakeholders can confidently handle cap rate changes and get the most out of their NNN property investments.

NNN Property Spotlight

Absolute NNN Gas Station | $2.2 million | 6% Cap Rate | Duluth, GA

Valero Gas Station located at 3931 Peachtree Industrial Blvd, Duluth, GA 30097. The site consists of roughly 1,500 rentable square feet of building space on estimated 0.38-acre parcel of land. This Valero Gas Station is subject to a 15-year absolute triple-net (NNN) lease, which commenced December 29th, 2017. The current annual rent is $132,371 and is scheduled to increase by 1% every year throughout the base term and in each year of the three (3), five (5)-year renewal options. Contact for OM, Rent Schedule & Demographics

Original 15-Year Absolute Triple-Net (NNN) Lease

+/- 8 Years Remaining

Three (3), Five (5)-Year Tenant Renewal Options

1% Annual Rent Increases

Net Lease Gas Stations Offer Bonus Depreciation

Valero Gas Station located at 3931 Peachtree Industrial Blvd, Duluth, GA 30097

Industry News Roundup

Stay up to date with the latest news and developments in the triple net (NNN) industry with our curated roundup of headlines from around the web.

-Waiting for lower triple net lease cap rates (Read More)

-Cap rates may have hit their high point (Read More)

-3 net lease REITS that are better than Realty Income (NYSE: O) (Read More)

-The growth and opportunities in the car wash market (Read More)

-Aldi to add 800 stores to network by 2028 (Read More)

NNN Fast 5

1. Rising Demand: Increased interest from investors seeking stable income streams has driven up demand for triple net lease properties across various sectors, including retail, office, and industrial.

2. Tenant Diversification: With a growing emphasis on tenant creditworthiness, investors are focusing on properties with financially stable tenants, diversifying their portfolios to mitigate risks associated with lease expirations and economic downturns.

3. E-commerce Impact: The rise of e-commerce continues to reshape the retail landscape, prompting tenants and landlords to adapt. NNN properties leased to essential retailers, e-commerce distribution centers, and last-mile logistics facilities are gaining traction.

4. Interest Rate Sensitivity: Investors are closely monitoring interest rate movements, as rising rates could impact cap rates and property valuations. The Federal Reserve's monetary policy decisions have a direct bearing on investment sentiment and capital flows into NNN properties.

5. Lease Structure Innovations: Landlords and tenants are exploring innovative lease structures to address evolving market dynamics and operational needs. This includes variations in lease terms, rent escalations, and provisions related to property maintenance and upgrades.

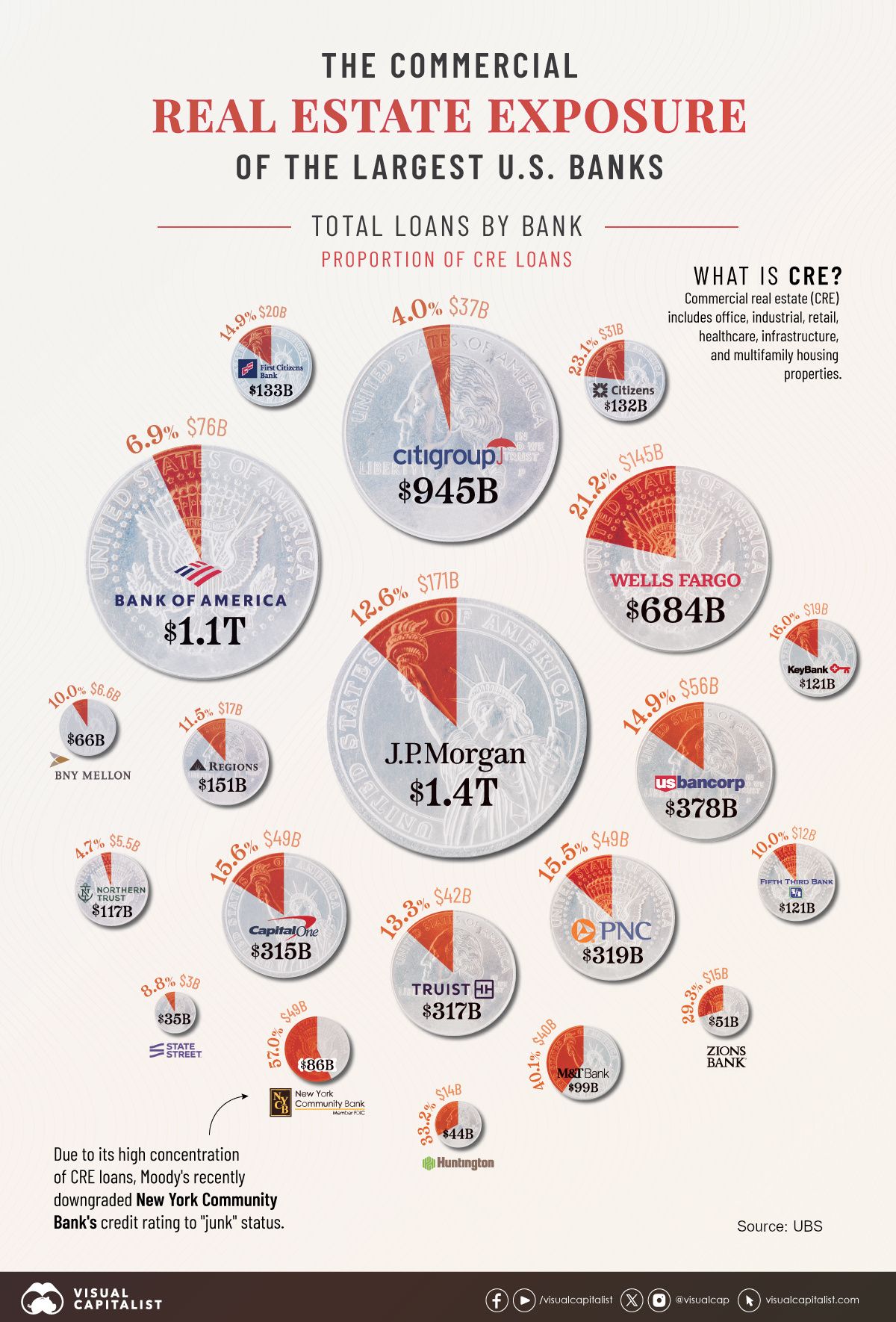

Visual of the Day

Was this email forwarded to you? Don't miss out on this valuable opportunity to elevate your knowledge and expertise in the world of NNN investment properties. Sign up for Hughes CRE Insider today and join our community of commercial real estate professionals committed to success.

To subscribe to Hughes CRE Insider and stay up-to-date with the latest NNN investment property insights, click here (Subscribe).

Thank you for choosing Hughes CRE Insider as your trusted source for Triple Net investment property news and analysis.

Best regards,

Hughes CRE Insider Team