🏢 Your Source for Commercial Real Estate, Business Brokerage and M&A Insights

At Hughes Commercial, we deliver actionable insights and strategies at the intersection of commercial real estate (CRE), business brokerage, and mergers & acquisitions (M&A). Each edition unpacks market trends, investment strategies, and deal-making opportunities to help you navigate CRE assets, business transactions, and portfolio growth.

Whether you're exploring income-producing properties or negotiating business deals, our goal is to equip you with the tools to seize opportunities and build lasting success.

Receive Honest News Today

Join over 4 million Americans who start their day with 1440 – your daily digest for unbiased, fact-centric news. From politics to sports, we cover it all by analyzing over 100 sources. Our concise, 5-minute read lands in your inbox each morning at no cost. Experience news without the noise; let 1440 help you make up your own mind. Sign up now and invite your friends and family to be part of the informed.

Featured Article

When most investors talk about adaptive reuse, their minds go straight to urban centers: warehouse loft conversions, trendy food halls, or mixed-use high-rises.

But there’s a less flashy corner of the market where adaptive reuse is quietly creating strong returns:

👉 Small towns.

And for savvy investors and developers, it’s one of CRE’s most underrated opportunities.

🏙️ What Is Adaptive Reuse, Anyway?

Adaptive reuse is the process of taking an existing, often underutilized structure, and repurposing it for a new commercial use—without tearing it down.

Think:

An old bank branch becoming a QSR drive-thru

A former auto repair shop turned into a retail cannabis dispensary

A shuttered grocery store converted to medical or dental offices

These types of projects are everywhere in secondary and tertiary markets, where:

Older buildings are plentiful

Demolition and construction costs are rising

Local leaders are eager to fill vacancies and revitalize Main Street

💰 Why It Makes Financial Sense

Here’s the kicker: adaptive reuse deals in small towns are often cheaper, faster, and less risky than ground-up development.

✅ Lower Acquisition Costs

Vacant or obsolete buildings in rural or smaller markets often trade well below replacement cost.

✅ Compressed Timelines

Compared to a full new build, reuse projects often move faster—especially with local support.

✅ Access to Incentives

Many towns will offer grants, tax abatements, or zoning flexibility just to get a property back on the tax roll.

🔍 Real-World Example

We recently saw a former CVS in a small-town downtown get repositioned as a regional bank branch and shared office space.

The investor:

Bought the building at a discount

Did light cosmetic and systems upgrades

Locked in a long-term lease with a national tenant

The result?

Double-digit yield in a market most overlook.

⚠️ What to Watch Out For

Not every old building is a goldmine. Be mindful of:

Zoning restrictions (some uses may not be permitted without a variance)

Environmental issues (gas stations and dry cleaners can come with baggage)

CapEx surprises (especially with older HVAC, roof, or plumbing systems)

A thorough inspection and strong local team are critical.

🧠 Bottom Line

In today’s market—where new construction is expensive and competition is fierce in gateway cities—small-town adaptive reuse is a smart, strategic play.

You’re not just investing in real estate. You’re:

Solving a local vacancy problem

Revitalizing a downtown corridor

Creating sticky, long-term cash flow

It’s CRE with purpose—and profit.

🚀 Fast-Track Your Property Sale with Our 100-Day List-to-Close Solution

Looking to sell your commercial property quickly and efficiently? Hughes Commercial, in partnership with Ten-X, offers a streamlined process to take your property from listed to closed in just 100 days. Here’s how we make it happen:

🔹 Efficient, Low-Risk Selling with Ten-X 🔹

✅ Streamlined Process

45-day targeted marketing campaign

48-hour online bidding event

Non-contingent closing within ~30 days for fast, reliable execution

✅ No Upfront Costs

Sellers pay nothing upfront—Ten-X is compensated by the buyer upon a successful sale

✅ Seller Protection

Set a reserve price and sell only if that price is met, minimizing downside risk

✅ High Certainty of Close

Buyers are prequalified and must provide proof of funds

10% non-refundable earnest money deposit (EMD) required from day one

✅ Comprehensive Due Diligence

Phase I and Property Condition Assessment reports (~$2,200 each) provided upfront

Sellers reimburse Ten-X only if the property sells—otherwise, the reports are free

✅ Global Buyer Reach & Premium Marketing

Exposure to a vast network of qualified buyers through CoStar, LoopNet, and Ten-X

Complimentary Diamond Ad included ($30,000–$50,000 value) for maximum visibility

👉 Maximize your property's value with a proven platform—contact us today to get started!

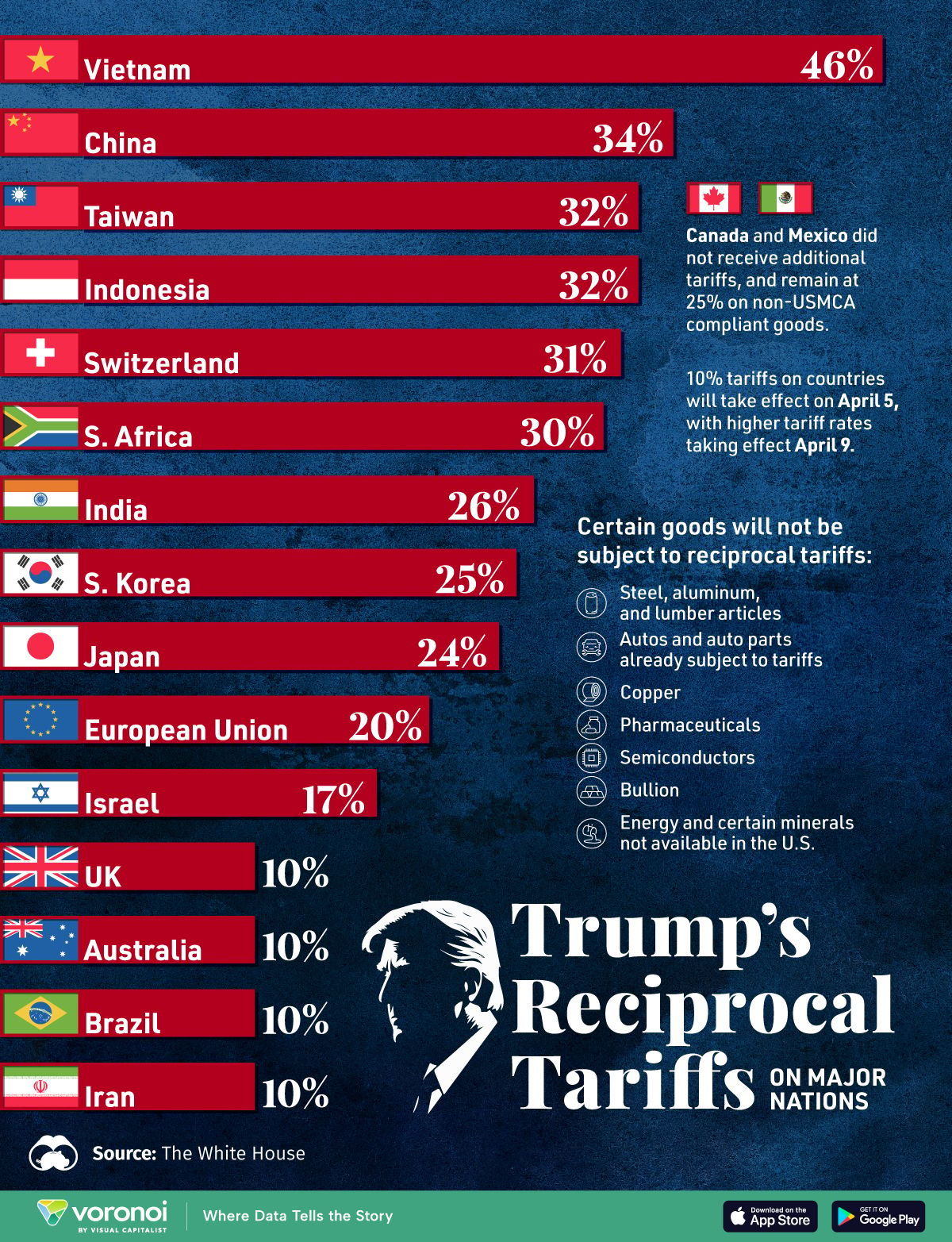

Visual of the Day

Was this email forwarded to you? Don't miss out on this valuable opportunity to elevate your knowledge and expertise in the world of commercial real estate, business brokerage and M&A activity. Sign up for Hughes Commercial Insider today and join our community of commercial real estate professionals committed to success.

To subscribe to Hughes Commercial Insider and stay up-to-date with the latest insights, click here (Subscribe).

Best regards,

Hughes Commercial